Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 22 November 2016 00:08 - - {{hitsCtrl.values.hits}}

During a recent RIU Investor forum in London, it was found that the number one cause of both confusion and concern amongst non-resident Sri Lankans (NRSL) was the perceived lack of clarity on how funds can be channelled in and out of Sri Lanka from the UK and other parts of the world. In the search for clarity, RIU met with the head of the Exchange Control Office in Colombo in the hope that she can shed some light on the issue.

The Exchange control office of Sri Lanka is located at the Central Bank building and is responsible for monitoring cross-border fund transfers. Due to the overwhelming demand for information on the regulatory environment on the transfer of funds in and out of Sri Lanka by non-resident Sri Lankans (NRSLs) living in other parts of the world, RIU recently met with Yvette Fernando, Controller of Exchange from the Exchange Control Department of the Central Bank of Sri Lanka.

The main question that was asked by many non-resident Sri Lankans is how funds can be transferred into buying property from outside Sri Lanka and transferred out again after the sale of the same property. In response, the Controller of Exchange said that essentially, there are four types of situations as categorised by the Central Bank that can be described where funds are required to be transferred back to the island.

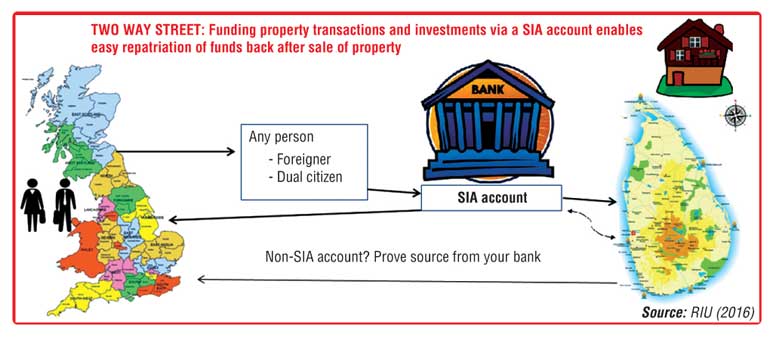

In the first scenario, if anybody wants to buy a property or make an investment in Sri Lanka they should bring the funds in through a Securities Investment Account (SIA) which can be arranged through their own bank. Once funds are transferred through an SIA account for the purpose of acquiring a property, the funds can be transferred back to the host country without any restriction and under the surveillance of the Central Bank. This category of people can include any person such as a non-resident of Sri Lanka a dual citizen or foreigner with a no link with Sri Lanka.

In some instances second or third generation Sri Lankans not born in Sri Lanka, living overseas may have ancestral property that they have acquired through inheritance or gift deeds. This category of people would be subject to an annual limit of $ 20,000 that can be taken out at a time in Sri Lanka if they sold their property.

While the above is a simple approach to facilitate investments into Sri Lanka there are situations when any of the above citizens have already invested or purchased property through a non- SIA account in the past. In this situation repatriating the funds back to the host country will require proof that the funds were bought in and used for the stated purpose. Documentation and procedure to establish the case for the same can be handled by the respective commercial bank which will be able to guide the process on a case-by-case basis.

There are also situations where individuals of families will be migrating out of the island and will take funds out of the island with them, such people will be subject to the existing migration allowance. A migrant is defined as a person born in Sri Lanka and living abroad. A migrant is eligible for an initial migrant allowance of $ 150,000 per individual aged 18 years and above and an annual allowance of $ 20,000 after 12 months from the full utilisation of the migration allowance.

For more information, contact [email protected].