Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 7 November 2016 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

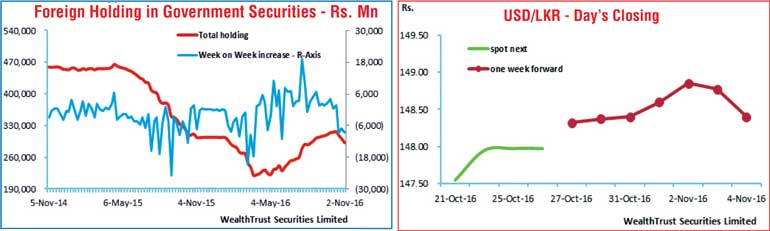

The secondary bond market ending 4 November witnessed a week of mix fortunes with activity drying up at the beginning of the week ahead of the weekly Treasury bill auction. However following the outcome of the weekly Treasury bills auction, where weighted averages were seen declining for the first time in three weeks, buying interest was seen returning to markets driving yields on the liquid maturities of 15.09.19 and 01.03.21 to weekly lows of 11.48% and 11.70% respectively with activity increasing once again.

Nevertheless yields on the said maturities were seen increasing once again to weekly highs 11.55% and 11.75% respectively followed by the 01.05.20 maturity increasing to 11.70% as well on the back of substantial foreign selling interest. Foreign selling of Rupee bonds which has been prevalent over the past two weeks, recorded an outflow of Rs. 8.51 b for the week ending 2 November 2016.

In money markets, the overnight call money and repo rates increased marginally during the week to average 8.43% and 8.72% respectively as the net liquidity shortfall was seen increasing to Rs. 34.75 b against its previous week of Rs. 25.06 b.The Open Market Operations (OMO) Department of the Central Bank of Sri Lanka continued to infuse liquidity by way of overnight reverse repo auctions at weighted averages of 8.50%.

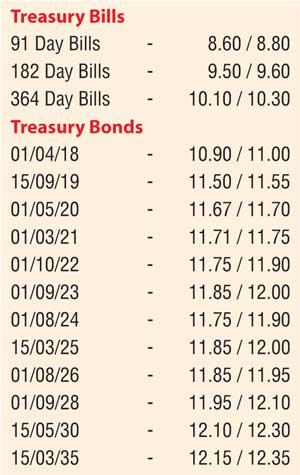

Rupee closes mostly unchanged

The USD/LKR rate on one week forward contacts were seen dipping to a low of Rs. 148.80/90 during the early part of the week against its previous weeks closing levels of Rs. 148.30/45 on the back of foreign selling in rupee bonds coupled with seasonal importer demand outweighing export conversions. However it appreciated once again during the latter part of the week to close the week at Rs. 148.35/45. The daily USD/LKR average traded volume for the first four days of the week stood at $ 34.24 m.

Some of the forward dollar rates that prevailed in the market were one month - 148.90/00; three months - 150.80/90 and six months - 153.25/35.