Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 8 December 2015 00:05 - - {{hitsCtrl.values.hits}}

Reuters: Sri Lankan shares closed at their lowest in more than eight months on Monday on worries that the new budget proposals would hit earnings of financial firms.

Sri Lankan police detained a former chairman of the country’s stock market regulator on Monday amid an investigation into financial misappropriation, days after detaining another top regulatory official.

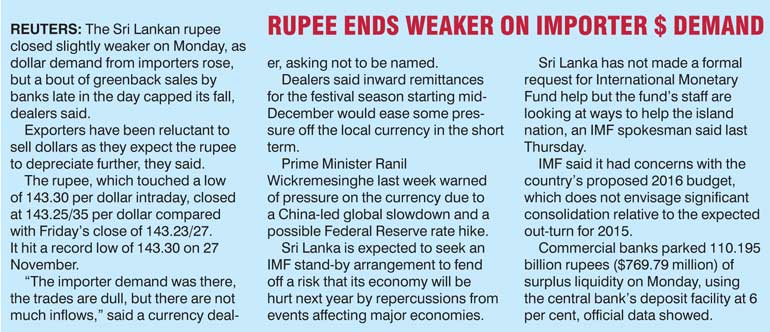

The International Monetary Fund on Monday said Sri Lanka’s 2016 budget raises questions about its ambitious revenue and capital expenditure targets as the government is falling far short of steps needed to improve the tax system.

Investor sentiment was also dented after Prime Minister Ranil Wickremesinghe’s warning last week of lower economic growth in 2016 due to the global slowdown.

The main stock index ended 0.16 per cent weaker at 6,858.63, its lowest level since 31 March.

The index fell into oversold territory with the 14-day Relative Strength Index at 29.402 versus Friday’s 30.523, Reuters data showed. A level between 70 and 30 indicates the market is neutral while a level of 30 or below indicates the market is oversold.

“It was another very thin trading day,” said SC Securities (Pvt) Ltd. Head of Research Yohan Samarakkody.

“The foreign participation is low, expecting a federal rate hike, while local participation was low due to the festive season and the ongoing investigations,” he said.

Local institutions and retail investors remained on the sidelines, analysts said.

Foreign investors were net sellers of Rs. 3.43 billion worth of equities so far this year, but they bought a net Rs. 55.5 million worth of shares on Monday.

Turnover was Rs. 388.9 million, well below this year’s daily average of Rs. 1.1 billion.

Shares of Sri Lanka Telecom Plc dropped 1.90 per cent while Cargills (Ceylon) Plc fell 2.43 per cent.

The Government on 20 November announced a raft of steps, including the removal of a 0.3 per cent share transaction levy, to stimulate trading in the share market and increase liquidity.

Rating agency Fitch on 24 November said Sri Lanka’s 2016 budget provides no clear plan for fiscal consolidation over the medium term and the absence of such a framework will put more pressure on the fiscal deficit.