Monday Mar 09, 2026

Monday Mar 09, 2026

Tuesday, 1 March 2016 00:13 - - {{hitsCtrl.values.hits}}

Last Tuesday, Sri Lanka (B1 stable) gained more than $2 billion in infrastructure and education financing from the Asian Development Bank (ADB, Aaa stable). The ADB’s commitment followed Sri Lanka’s public request for support from the International Monetary Fund (IMF) by just weeks. The sovereign’s recourse to multilateral financing underscores its large external financing needs and the limited scope for market financing to meets those needs, revealing Sri Lanka’s credit-negative vulnerability to external event risk.

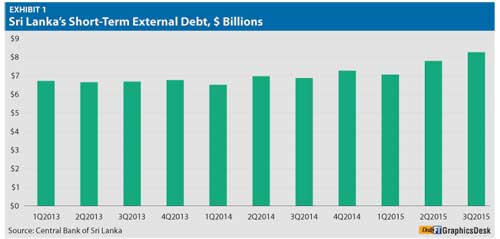

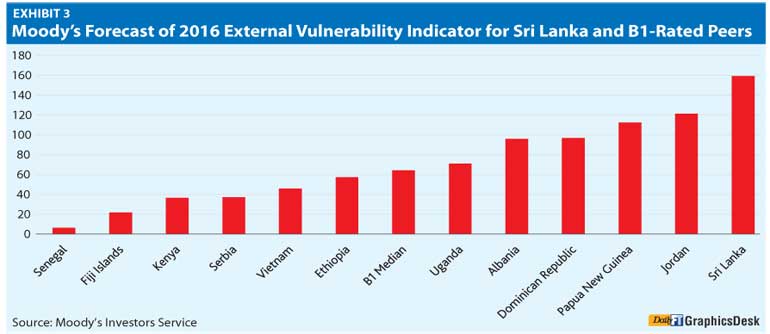

We estimate that Sri Lanka ramped up its external debt burden to about 57% of GDP in 2015 from 49% in 2010, when credit conditions were more favorable, and is now left with high repayments. However, global financing conditions have tightened, with higher risk aversion diminishing capital flows to emerging markets. In Sri Lanka, the decline of capital flows has resulted in higher recourse to short-term external financing (see Exhibit 1) and a sizable decline in foreign exchange reserves (see Exhibit 2).

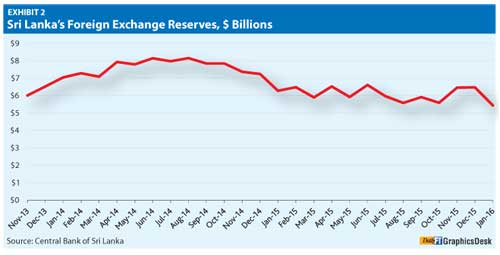

In September 2015, the Central Bank of Sri Lanka reduced foreign exchange interventions and allowed greater exchange rate flexibility to preserve foreign exchange reserves. Since then, the currency has depreciated by 7.4% while foreign currency reserves have declined. Together with a rise in short-term debt, Sri Lanka’s external vulnerability indicator (which we calculate as [short-term external debt + currently maturing long-term external debt + total non-resident deposits over one year]/official foreign exchange reserves), has risen and is higher than B1-rated peers (see Exhibit 3).

Amid tighter external liquidity, domestic credit growth rose sharply. Private-sector credit growth increased to 25% in December 2015, far faster than the average growth of 8% in 2014. To the extent that it finances imported goods and services or replaces depleted external financing, high growth in domestic credit exacerbates credit-negative pressure on the country’s current account balance and risks fuelling further declines in reserves.

In response, the Central Bank raised its standing deposit and lending facility rates by 50 basis points each on 19 February, which offsets some of the risks posed by lower external inflows and higher domestic credit growth. However, the higher rates will likely dampen economic growth. The policy rate increases will also raise domestic debt-servicing costs for the government, which are already high. The interest rate on one year treasury bills was 8% in January 2016, up from less than 6% in December 2014. In addition, with foreign currency debt making up about 40% of total government debt, further depreciation of the rupee will raise external debt costs. Interest expenditures accounted for 32.3% of government revenues in 2015, one of the highest among B-rated sovereigns. A rise in bond yields or depreciation of the rupee will worsen this ratio.

In response, the Central Bank raised its standing deposit and lending facility rates by 50 basis points each on 19 February, which offsets some of the risks posed by lower external inflows and higher domestic credit growth. However, the higher rates will likely dampen economic growth. The policy rate increases will also raise domestic debt-servicing costs for the government, which are already high. The interest rate on one year treasury bills was 8% in January 2016, up from less than 6% in December 2014. In addition, with foreign currency debt making up about 40% of total government debt, further depreciation of the rupee will raise external debt costs. Interest expenditures accounted for 32.3% of government revenues in 2015, one of the highest among B-rated sovereigns. A rise in bond yields or depreciation of the rupee will worsen this ratio.

An agreement with the IMF and financing from the ADB will provide some liquidity and thereby ease immediate financing pressures. At the same time, the financing will likely be at more favorable terms than market borrowing, alleviating debt servicing cost pressures to some extent.

Over the next three years, potential financing from the IMF can lead to an agreement to implement fiscal consolidation. Although this will lower Sri Lanka’s high fiscal deficits and debt, it will likely require a widening of the small tax base and revisiting the government’s expenditure commitments. Moreover, such an agreement will likely restore investor confidence in Sri Lanka’s policy framework, and ultimately support more stable external inflows.