Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 5 May 2017 00:10 - - {{hitsCtrl.values.hits}}

Sri Lankan stocks have rebounded strongly in 2017, reversing a two-year trend where it underperformed several other asset classes. The All Share Price Index (ASPI) of the Colombo Stock Exchange has returned 7.4% in the first four months of this year, closing at 6,610 while the more liquid S&P20 index has returned 10.1%. The market may have further price appreciation potential as the ASPI remains well below the five-year and ten-year highs of 7,606 and 7,812 respectively.

According to Asia Securities Chairman Dumith Fernando: “While some recent press articles have viewed this discount to historical valuations as a negative, we believe that understanding the current situation requires a more sophisticated and nuanced analysis that could generate attractive opportunities for smart investors.”

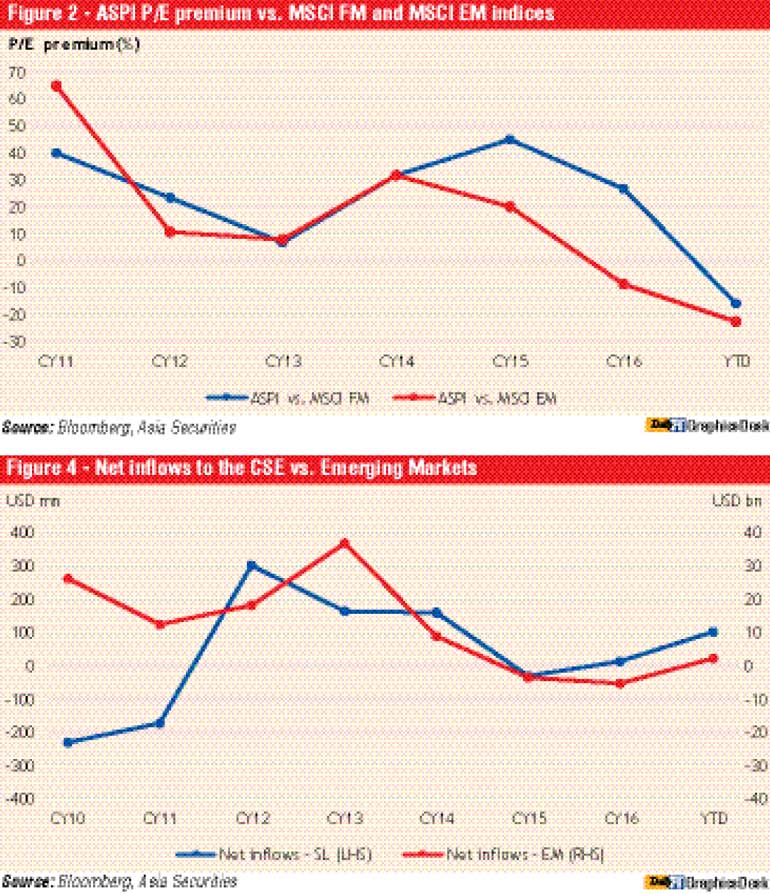

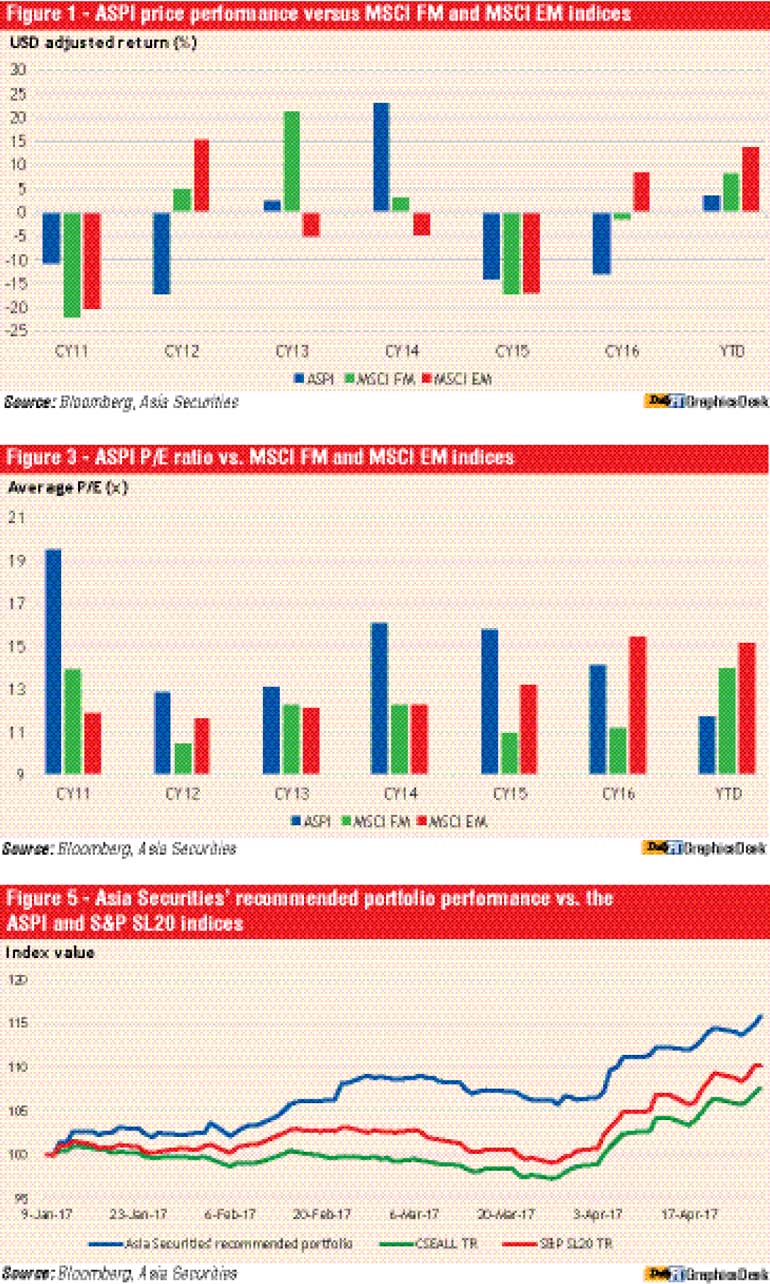

Asia Securities analysed the Sri Lankan stock market performance in comparison to regional markets to understand whether its recent performance is unique to Sri Lanka or one of fluctuating emerging and frontier market flows. As shown in figure 1, US Dollar-adjusted ASPI returns have directionally moved similarly to other frontier and emerging markets’ (as measured by the MSCI Frontier Markets and Emerging Markets indices) apart from in 2012. Furthermore, the ASPI has outperformed both frontier and emerging markets in three out of six years.

In the period immediately prior to years of relative underperformance of the ASPI, its P/E ratios had expanded well above the P/E ratios of the MSCI Frontier Markets and Emerging Markets indices as shown in figure 2. Intuitively, this often leads to international funds switching from Sri Lanka to other cheaper markets leading to relative underperformance.

However, the ASPI has become cheaper over the last few years and is now trading at an average P/E of 11.7x against a five-year high of 16.1x as well as at a discount to the MSCI Frontier and Emerging indices (see Figures 2 and 3). The valuation gap between the ASPI and the MSCI FM index has narrowed to a negative 16.3%. The gap between the ASPI and the MSCI EM index is at negative 23.0%. Both of these data points suggest further inflows to the Sri Lankan stock market from global investors seeking better value opportunities, a glimpse of which was witnessed in the first four months of this year.

“We have seen much higher international investor interest in the local markets this year. In particular, strategic interest has surprised positively,” says Fernando.

The market becoming cheaper on its own wouldn’t necessarily lead to a correction in the ASPI unless the market sees credible foreign flows into equities to drive a re-rating. As figure 4 shows, net foreign inflows into the CSE is highly correlated with net foreign inflows into emerging markets. Up to end April this year there was a net foreign inflow of $ 103 m into the CSE against a low $ 13 m net foreign inflow in 2016. Supporting this was net foreign inflows to emerging markets that have picked up to $ 2.4 b from an outflow of $ 5.1 b last year. Sri Lanka has been receiving an outsized proportion of total foreign flows into emerging market equities.

While all the relative valuation and fund flows data paint a broadly positive picture, there are, arguably, some fundamental near term issues which gives investors a cause for concern. Chief amongst them is still suboptimal policy certainty stemming from a unity Government that has two main political parties with diverse ideologies struggling to find common ground on a few critical economic matters. While there is evidence of improvement in policy-making process and speed over the last two years, significantly improving investor confidence will require remarkable improvement on the policy side.

Asia Securities Head of Research Kanishka Perera thinks that “whilst there have been some impressive gains in macroeconomic indicators, we have seen a deterioration of some key variables, in particular the country’s foreign reserve position and inflation, and resulting rise in policy rates.” According to him the challenge for successful equity investing in Sri Lanka in such a scenario is how one identifies companies with underlying growth and earnings quality characteristics that may defy somewhat tepid macro positives.

As argued in Asia Securities’ equity strategy report published in January this year, titled ‘Sri Lanka: Equity Strategy 2017 – Dig Deep to Unearth Value,’ not unlike 2016, this is a year for stock selection based on bottom-up conviction calls. Asia Securities’ key picks for 2017 are strong ROE generators trading at reasonable valuation and more importantly, have a business model that is relatively unaffected by any negative headwinds and are skewed towards specific active growth engines of the economy. In terms of sectors, Asia Securities is positive on the Construction value chain while it has selectively picked several other stocks in multiple sectors for the Asia Securities recommended portfolio. The Asia Securities liquidity-weighted portfolio has generated a total return of 15.8% through April 30, 2017 (see Figure. 5). This compares favorably to a performance of 7.6% for the ASPI and 10.1% for the S&P SL20, during the same period.

According to Perera “at initiation, in January 2017, the Asia Securities recommended portfolio was estimated to return 25.2% for the year on a liquidity-weighted basis. It’s been beating our expectations so far.”

This bottom-up approach also generated a total return of 26.1% for the Asia Securities liquidity-weighted portfolio in 2016 against 2.6% for the ASPI and 12.0% for the S&P SL20.

While there has been limited domestic investor participation on the buying side, partly due to the attractiveness of high interest rates on certain fixed income instruments such as fixed deposits, 2017 may be a year that generates significantly higher returns for those investing in well-researched, carefully selected, liquid stocks.