Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 24 September 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

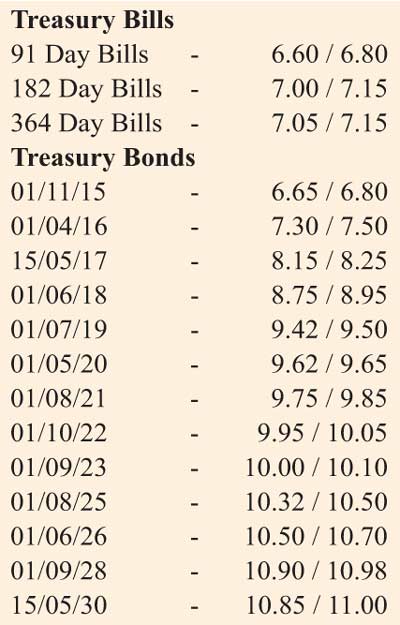

In secondary bond markets yesterday, yields on the shorter end of the yield curve was seen increasing as the liquid maturities of 15 May 2017 and 1 June 2018 was seen hitting intraday highs of 8.20% and 8.80% respectively against its previous days closings of 8.10/15 and 8.45/60.

In addition, a limited amount of activity was witnessed on the maturities of 1 July 2019, 1 May 2020, 1 August 2021 and 1 September 2023 within the range of 9.43% to 9.47%, 9.60% to 9.63%, 9.80% to 9.85% and 10.00% to 10.05% respectively.

Meanwhile, continued demand for secondary market bills saw durations centering March to August 2016 change hands within the range 7.00% to 7.15% once again.

In money markets yesterday, surplus liquidity dipped to Rs. 59.73 billion yesterday as overnight call money and repo rates remained steady to average 6.35% and 6.52% respectively.

Rupee holds steady near Rs. 141

The USD/LKR rate on spot contracts was seen closing the day at levels of Rs. 140.95/00 subsequent to changing hands within a narrow band of Rs. 140.95 to Rs. 140.98. The total USD/LKR traded volume for 22 September was $ 39.05 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 141.55/65; three months – 142.80/00 and six months – 144.15/35.