Tuesday Feb 10, 2026

Tuesday Feb 10, 2026

Friday, 3 June 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

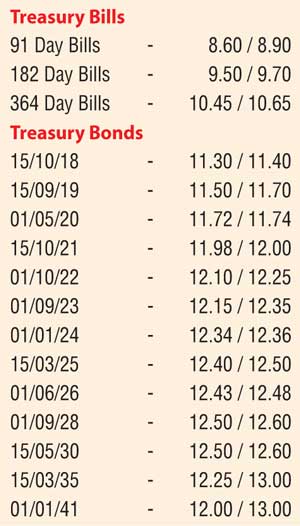

Treasury bond yields in the secondary market continued to decline, with considerable buying interest composing mainly of the liquid maturities i.e. the 2018’s consisting of 15.10.18 and 15.11.18 as well as other maturities such as the 01.05.20, 15.10.21, 01.01.24 and 01.06.26.

Yields of these maturities hit intraday lows of 11.35% on the 2018’s and 11.70%, 11.99%, 12.33% and 12.43% on the rest, as against the previous day’s closing levels of 11.45/55 on the 2018’s and 11.73/80, 12.08/12, 12.40/45 and 12.50/56 on the other maturities.

Furthermore, on the shorter end of the yield curve, the 15.06.17 maturity was seen changing hands at levels of 10.75% to 10.80% while on the longer end of the yield curve the 15.05.30 maturity changed hands at levels of 12.50% to 12.55%.

Meanwhile in money markets, the overnight call money and repo rates averaged 8.16% and 8.05% respectively as the Open Market Operations (OMO) Department of the Central Bank injected an amount of Rs.10 billion at a weighted average rate of 7.99%.

Rupee appreciates again

The rupee rate on active spot next contracts was seen appreciating once gain to close the day at Rs.147.90/10 against its previous day’s closing levels of Rs.148.20/35. The total USD/LKR traded volume for 1 June 2016 was $ 37.55 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 148.70/90; 3 Months - 150.40/70 and 6 Months - 152.70/00

Reuters: Rupee forwards ended firmer on Thursday as banks, led by State-owned lenders, sold dollars amid light demand for the US currency from importers, dealers said.

Dollar/rupee forwards, known as spot next, ended at 147.75/90 per dollar with compared with Wednesday’s close of 148.25/40.

Spot next, which acts as a proxy for the spot currency, indicates the exchange rate for the day following conventional spot settlement, which is five days ahead for Thursday’s trade.

“A State bank started selling (dollars) at 147.80 and we saw some other banks also selling. The importer demand (for dollar) was there but because of state bank selling rupee ended firmer,” a currency dealer said.

Two State-run banks, through which the Central Bank usually directs the market, at times sell dollars to curb falls in the rupee.

Central Bank officials were not available to comment on whether the selling was prompted by the monetary authority.

There was little impact on the rupee from Finance Minister Ravi Karunanayake’s announcement on Tuesday that Japan would lend $4.2 billion to Sri Lanka through both, a loan and bond financing, in the next two years.

The spot currency was not traded on Thursday.

The spot rupee reference rate has been pegged at 145.75, dealers said. The Central Bank had fixed the spot rate at 143.90 per dollar until 2 May.

Dealers said the rupee would continue to face pressure despite foreign inflows into Government securities and expectations of further inflows, unless the inflows are large enough to boost reserves.

Foreign investors were net buyers of 7.23 billion rupees ($49.28 million) in the week ended 25 May, Central Bank data showed.

The Government is in the process of borrowing up to $3.5 billion from foreign sources via syndicated loans, sovereign bonds, and Islamic bonds, Karunanayake said last week.

Analysts, however, said foreign inflows from such loans or bond issues would ease the pressure on the rupee.