Monday Mar 09, 2026

Monday Mar 09, 2026

Friday, 24 July 2015 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Yields in secondary bond markets r emained mostly unchanged ahead of today’s monetary policy announcement for the month of July.

emained mostly unchanged ahead of today’s monetary policy announcement for the month of July.

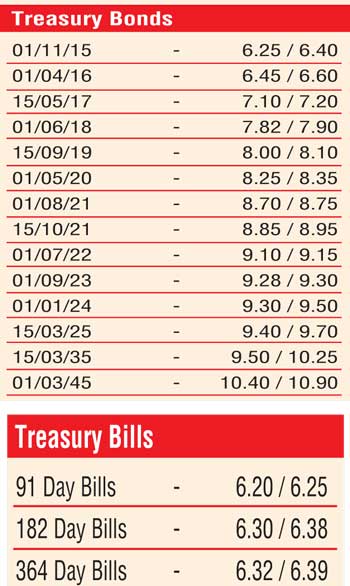

The Central Bank of Sri Lanka held policy rates steady at 6% and 7.50% in June, for a second consecutive month. Limited amount of activity was witnessed in maturities consisting of 1 August 2021, 1 October 2022 and 1 September 2023 within the yields of 8.70% to 8.74%, 9.13% to 9.16% and 9.30% to 9.35% respectively. However, activity dried up considerably towards the later part of the day.

Meanwhile in secondary bill markets, September and October 2015 maturities were seen quoted at levels of 6.05/10 and 6.22/25.

In money markets, surplus liquidity of Rs 82.56 billion was deposited at Standing Deposit Facility Rate (SDFR) of 6.00% whilst the overnight – call money and repo rates averaged at 6.13% and 5.61% respectively.

Rupee remains stable

Meanwhile, in Forex markets the USD/LKR rate on spot contracts remained steady for a third consecutive day to close at Rs. 133.70. The total USD/LKR traded volume for the previous day (22 July) stood at $ 71.50 million.

Some of the forward dollar rates that prevailed in the market were one month – 134.25/40, three months – 135.35/50 and six months – 136.75/00.