Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 14 June 2016 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

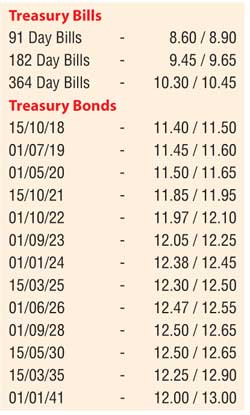

The secondary market bond yields increased yesterday, with selling interest consisting of mainly the eight and 10 year maturities of 01.01.24 and 01.06.26, at highs 12.40% and 12.50% respectively. This was in comparison to its opening levels of 12.15/25 and  12.35/40.

12.35/40.

Similarly, the yields of the 15.10.21 and 01.10.22 maturities too, increased to levels of 11.85/95 and 11.97/10 respectively, while on the shorter end of the yield curve the 15.10.18 maturity was seen increasing to levels of 11.40/50 as against its previous day’s closing levels of 11.30/35.

Meanwhile the foreign holding in rupee bonds was seen increasing once again to record an inflow of Rs.8.16 billion for the week ending 8 June against its previous week’s outflow of Rs.11.05 billion.

Meanwhile in money markets, the Open Market Operations (OMO) Department of Central Bank injected an amount for Rs.15 billion at a weighted average rate of 7.99% as the net deficit in the market stood at Rs.7.91. The overnight call money and repo rates remained mostly unchanged to average out at 8.18% and 8.05% respectively.

In Forex markets, the USD/LKR rate on spot as well as spot next contracts remained mostly unchanged to close the day at Rs.144.70/85 and Rs.144.75/85 respectively, subsequent to appreciating to highs of Rs.144.65 and Rs.144.72. The total USD/LKR traded volume for 10 June was $ 57.50 million. Given are some forward USD/LKR rates that prevailed in the market: one month – 145.45/55; three months – 147.10/30; six months – 149.50/70.