Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 31 July 2017 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

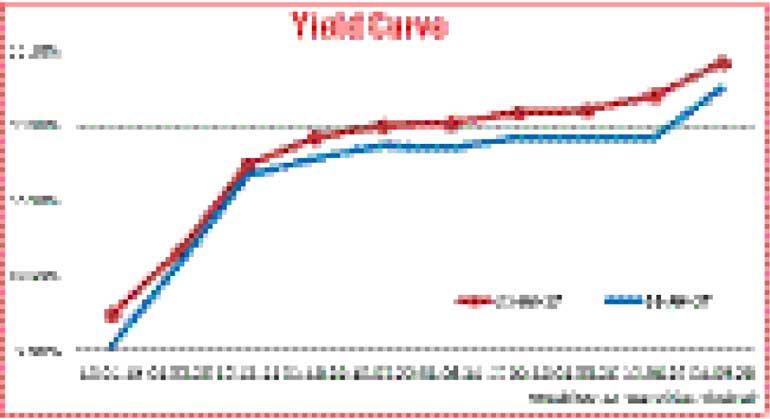

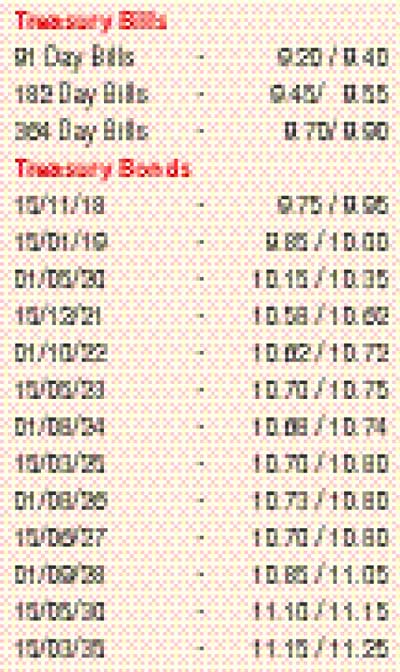

The secondary bond market remained active during the week ending 28 July as yields were seen see sawing within a narrow range across the yield curve and ending lower in comparison to its previous weeks closing levels. Activity centred on the liquid maturities of the two 2021’s (01.08.21 and 15.12.21), 15.05.23, 01.08.24, 01.08.26 and 15.06.27 as its yields were seen increasing from the beginning of the week to mid-week to weekly highs of 10.73%, 10.75%, 10.85%, 10.88%, 10.90% and 10.96% respectively.

However, foreign and local buying interest at these levels following the Treasury bond auctions conducted on Thursday 27 July under the new primary auction system saw yields tumbling once again to weekly lows of 10.55% each, 10.65% each, 10.75% and 10.80% respectively.

A fourth consecutive week drop in the weekly Treasury bill weighted averages coupled with foreign inflow into the government securities market for a third consecutive week to the tune of Rs. 2.3 billion for the week ending 26th July was seen as the reasons behind the drop in bond yields.

The daily secondary market Treasury bond transacted volume for the first four days of the week averaged Rs. 5.13 billion.

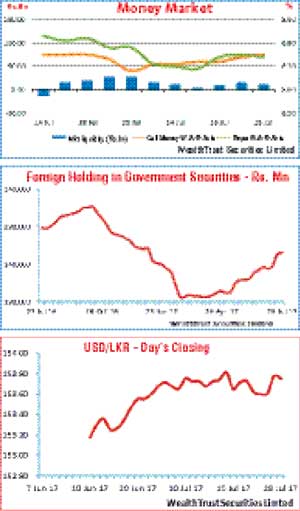

In money markets, liquidity averaged a net surplus of 9.9 billion during the week as call money and repo remained steady to average 8.73% and 8.72% respectively. The Open Market Operations (OMO) department of Central Bank was seen draining out liquidity during the week at weighted averages of 7.31% to 7.37% as well.

Rupee closes steady during the week

The Rupee on its spot contracts were seen closing the week broadly steady at Rs. 153.72/78 against its previous weeks closing of Rs. 153.70/75 subsequent to appreciating to a weekly high of Rs. 153.57/63 during the early part of the week.

Some of the forward dollar rates that prevailed in the market were one month – 154.75/85; three months – 156.70/80 and six months – 159.75/85.