Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 21 June 2016 00:22 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary market bond yields were seen edging up further yesterday on thin trades as market sentiment remained bearish.

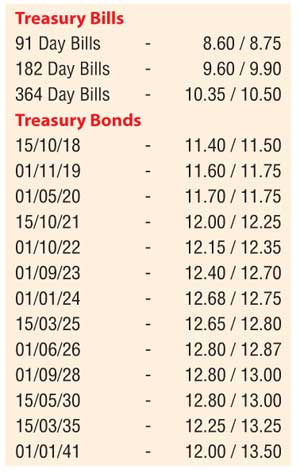

Selling interest on the maturities of 01.01.24 and 01.06.26 saw its yields edge up to intraday highs of 12.72% and 12.85% respectively against its previous day’s closing levels of 12.53/57 and 12.60/70. In addition, two-way quotes on the rest of the yield curve were seen increasing and widening as well.

Meanwhile in money markets yesterday, overnight call money and repo rates remained mostly unchanged to average 8.17% and 8.07% respectively as the Open Market Operations (OMO) department of Central Bank was seen injecting an amount of Rs.17.08 billion on an overnight basis by way of a reverse repo auction at weighted average rate of 7.96%.

Rupee dips further

Meanwhile in Forex markets yesterday, importer demand saw the USD/LKR rate on the one week forward contract depreciate further to close the day at Rs.146.70/05 against its previous day’s closing of Rs.146.60/10. The total USD/LKR traded volume for 17 June was $ 61.00 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 147.25/50; three months – 148.70/00; and six months – 150.75/00.