Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 2 September 2016 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

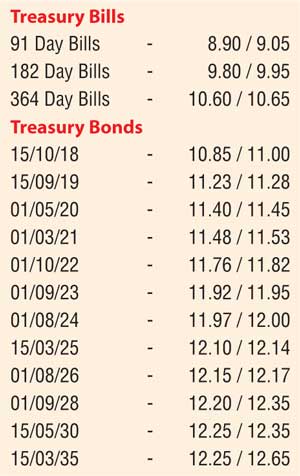

The secondary bond market witnessed increased activity yesterday as continued buying interest led to yields dipping across the curve for a second consecutive day. The liquid maturities of 15.09.19, 01.05.20, 01.03.21, 01.10.22, 01.09.23, 01.08.24, 15.03.25 and the two 2026’s (i.e. 01.06.26 and 01.08.26) saw its yields hit intraday lows of 11.26%, 11.40%, 11.50%, 11.80%, 11.92%, 12.00%, 12.13%, 12.17% and 12.16% respectively against its previous day’s closing levels 11.30/40, 11.52/58, 11.65/68, 11.90/93, 12.00/05, 12.06/10, 12.20/22 and 12.27/30 each.

In money markets, overnight call money and repo rates remained mostly unchanged to average 8.40% and 8.54% respectively as the net surplus liquidity stood at Rs.16.12 billion yesterday.

Rupee appreciates marginally

In Forex markets, the spot next rate was seen appreciating marginally to close the day at Rs.145.55/60 yesterday against its previous day’s closing of Rs.145.65/70.

The total USD/LKR traded volume for the 31 August 2016 was USD 39.01 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month - 146.25/35; 3 months - 147.90/00 and 6 months - 150.25/40.