Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 9 October 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

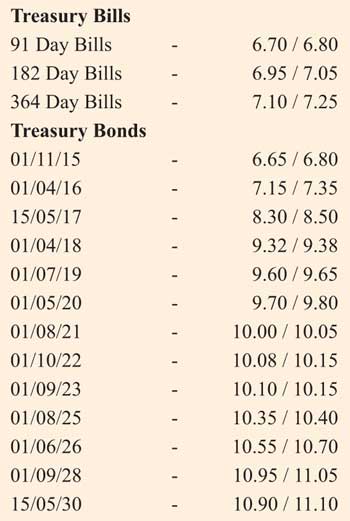

The secondary bond market witnessed continued buying interest yesterday for a second consecutive day as yields on the liquid maturities of 1 March 2021, 1 August 2021, 1 October 2022, 1 September 2023 and 1 August 2025 were seen hitting intraday lows of 10.00% each, 10.08%, 10.12% and 10.40% respectively against its previous day’s closing levels of 10.05/10 each, 10.10/15, 10.11/20 and 10.40/50. In addition the 15.07.17 maturity was seen changing hands within the range of 8.60% to 8.70% as well.

Meanwhile in secondary market bills, March and August 2016 bills were seen quoted at levels of 6.95/05 and 7.10/25 respectively.

Meanwhile in money markets, overnight call money and repo rates remained mostly unchanged to average 6.36% and 6.50% respectively despite surplus liquidity dipping further to Rs.49.55 billion yesterday.

Rupee remains mostly unchanged

The dollar/rupee rate remained mostly unchanged yesterday to close the day at Rs.140.50/55 in thin trade. The total USD/LKR traded volume for 7 October was $ 91.70 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 141.05/15; three months – 142.20/30; six months – 143.85/00.