Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 13 October 2015 01:06 - - {{hitsCtrl.values.hits}}

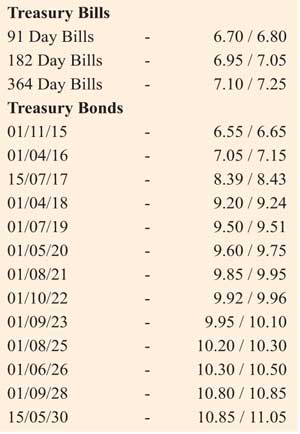

Wealth Trust Securities: The positive momentum in secondary market Treasury bond yields continued for a fourth consecutive day as yields dipped on the back of continued buying interest with the liquid maturities of 01.04.18, 01.07.19, 01.08.21, 01.10.22 and 01.09.28 declining to intraday lows of 9.20%, 9.50%, 9.90%, 9.95% and 10.80% respectively yesterday. In addition the 15.11.18 and 15.09.19  maturities were seen changing hands within the range of 9.45% to 9.55% and 9.55% to 9.60% as well while on the short end of the curve the 15.07.17 was seen changing hands within the range of 8.40% to 8.55% with volumes remaining high. Meanwhile demand for secondary market bills saw December 2015 changing hands at levels of 6.65%.

maturities were seen changing hands within the range of 9.45% to 9.55% and 9.55% to 9.60% as well while on the short end of the curve the 15.07.17 was seen changing hands within the range of 8.40% to 8.55% with volumes remaining high. Meanwhile demand for secondary market bills saw December 2015 changing hands at levels of 6.65%.

Meanwhile in money markets, the surplus liquidity on an overnight basis stood at Rs. 60.54 billion yesterday as overnight call money and repo rates decreased marginally to average 6.37% and 6.36% respectively.

The Rupee remains mostly unchanged. The dollar/rupee rate remained mostly unchanged yesterday to close the day at Rs. 140.35/45 as markets were at equilibrium. The total USD/LKR traded volume for 9 October was US $ 77.55 million. Some of the forward USD/LKR rates that prevailed in the market were One Month - 140.95/10; Three Months - 142.00/15 and Six Months - 143.65/75.