Tuesday Feb 10, 2026

Tuesday Feb 10, 2026

Friday, 25 November 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

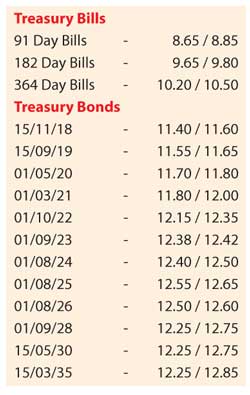

Secondary bond market yields continued to drop yesterday with continued buying interest, mainly of the 01.09.23, 01.08.24 and two 2025 maturities (i.e. 15.03.25 and 01.08.25) hitting intraday lows of 12.37%, 12.40%, 12.62% and 12.60% respectively, in comparison to the previous day’s closing levels of 12.50/57, 12.55/60 and 12.70/75. Furthermore, the 15.09.19 and 01.05.20 maturities too, traded within the range of 11.60% to 11.62% and 11.75% to 11.87%.

In money markets, the overnight repo rate increased marginally to average at 8.66% as the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka reduced the overnight cash infusion to Rs. 3 b at a W. Avg of 8.50%. The net deficit in the market stood at Rs.23.83 b.

Rupee depreciates marginally

Meanwhile in Forex markets, the USD/LKR rate on spot next contracts depreciated once again to close the day at Rs. 148.65/75 against its previous day’s closing level of Rs. 148.45/55. The total USD/LKR traded volume for the 23 November 2016 was $ 71.95 m.

Some forward USD/LKR rates that prevailed in the market were one month - 149.55/65; three months - 151.50/75 and six months - 154.05/20.

The closing, secondary market yields of the most frequently traded maturities: