Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 26 October 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

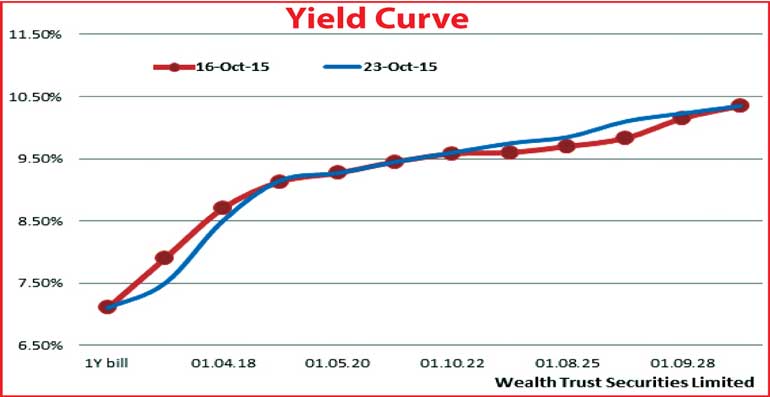

The secondary bond market ending 23 October witnessed a week of volatility as yields were seen increasing at the beginning of the week ahead of the monetary policy announcement on Tuesday for the month of October.

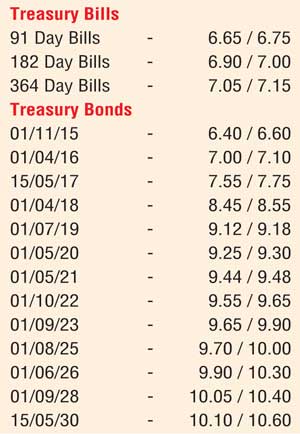

Yields on the liquid two maturities of 1 May 2021 and 1 October 2022 was seen increasing to weekly highs of 9.80% followed by the 2018, 2019, 2020, 2023 and 2025 increasing to highs of 9.00%, 9.25%, 9.40%, 9.70% and 9.80% respectively as well on the back of foreign selling interest.

However, following the announcement at where policy rates were held steady for a sixth consecutive month, buying interest was seen returning back to markets driving yields down.

On the back of this momentum yields were seen hitting weekly lows of 7.50%, 8.50%, 9.10%, 9.18%, 9.45%, 9.55%, 9.58%, 9.70% on the 2018, 2019, 2020, 2021, 2022, 2023 and 2025 maturities respectively. The outcome of the weekly Treasury bill auction, at where weighted averages were seen declining marginally for a second consecutive week added momentum to this trend.

Nonetheless, the announcement of four Treasury bond auctions to the tune of Rs. 30 billion in lieu of a Rs. 91.69 billion bond and coupon maturity due on 1 November curtailed the downward momentum as yields increase once again on the back of profit taking and selling interest.

The auction will see Rs. 7 billion each on a 3.10 year maturity of 15 September 2019 and a 6.11 year maturity of 1 October 2022 on offer along with Rs. 6 billion on a 12.10 year maturity of 1 September 2028 and Rs. 10 billion on a 19.04 year maturity of 15 March 2035. The previously recorded weighted averages on these maturities are 9.50%, 9.95%, 11.04% and 11.20% respectively.

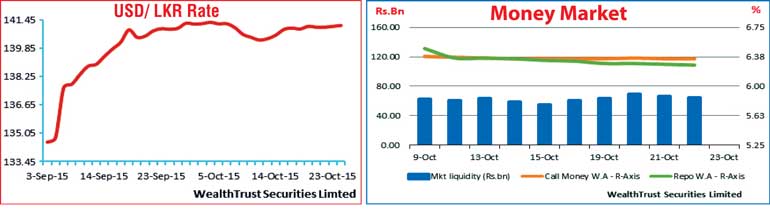

Meanwhile in money markets, overnight call money and repo rates decreased further during the week ending 23 October to average 6.35% and 6.28% respectively as surplus liquidity stood at an average of Rs. 66.22 billion for the week. The USD/LKR rate depreciated marginally during the week to close the week at levels of Rs.141.10/20 against its previous weeks closing level of Rs.140.30/35 on the back of seasonal importer demand outweighing export conversions. The daily average USD/LKR traded volumes for the first four days of the week stood at $ 59.50 million.

Some of the forward dollar rates that prevailed in the market were one month - 141.75/85; three months - 142.80/00 and six months - 144.50/70.