Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 15 August 2017 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

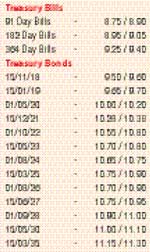

The activity in the secondary bond market moderated considerably yesterday with limited trades seen on the liquid maturities of 15.12.21 and 15.05.23 at levels of 10.30% and 10.70% to 10.75% respectively.

In addition, the shorter end maturities of 15.11.18 and 15.01.19 were seen changing hands at levels of 9.50% and 9.60% to 9.70% respectively as well.

The total secondary market Treasury bond transacted volume for 11 August was Rs.5.04 billion.

In money markets, the overnight call money and repo rates decreased further to average 8.57% and 8.47% respectively as the net surplus liquidity in the system stood at Rs.22.37 billion yesterday.

The Open Market Operations (OMO) Department of the Central Bank of Sri Lanka drained out an amount of Rs.12.85 Billion on an overnight basis at a weighted average of 7.30% while attempt to drain out liquidity on a permeant basis was not successful once again as no bids were received for the two outright auctions with maturities of 31 and 38 days.

Rupee remains

mostly unchanged

In the Forex market, the USD/LKR rate on spot contracts remained mostly unchanged yesterday to close the day at Rs.153.10/15.

The total USD/LKR traded volume for 11 August was $ 27.56 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 153.85/95; three months – 155.40/50; and six months – 157.80/95.