Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 3 August 2016 00:03 - - {{hitsCtrl.values.hits}}

Reuters: The rupee edged up on Tuesday as foreign investors sold dollars to buy local currency bonds after the central bank’s policy  rate hike pushed yields higher, dealers said.

rate hike pushed yields higher, dealers said.

The central bank raised its main interest rates by 50 basis points each last week in a surprise move aimed at curbing stubbornly high credit growth that is adding to concern about inflationary pressures.

One-week rupee forwards, which have been acting as a proxy for the spot rupee, ended at 146.10/15 per dollar, up from Monday’s close of 146.22/30.

“Foreigners are buying into bonds. They are buying because the yields seems to be attractive for foreigners,” said a currency dealer, asking not to be named.

The spot rupee is tightly managed by the central bank, and market participants use the forward market levels for guidance on the currency.

The spot rupee was not traded on Tuesday.Spot-next, which are rupee forwards settled a day after the spot rupee settlement, ended at 145.95/146.05 per dollar, compared with Monday’s close of 146.06/08.

By Wealth Trust Securities

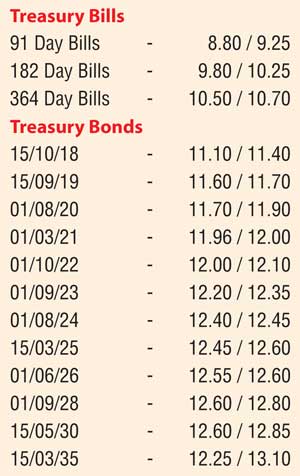

Secondary market bond yields remained mostly unchanged, ahead of the weekly Treasury bill auction due today.

The liquid maturities of 01.03.21, 01.08.24 and the two 2026 maturities (i.e. 01.06.26 and 01.08.26) were seen trading within a range of 11.98% to 12.00%, 12.43% to 12.45%, 12.58% to 12.60% and 12.65% to 12.68% respectively.

Today’s, weekly Treasury bill auction, will have on offer a total amount of Rs.22.5 billion consisting of Rs.7.5 billion each of the 91 day, 182 day and 364 day maturities.

At last week’s auction, which was a day prior to the policy rate hike, the weighted averages of both the 182 day and 364 day maturities decreased by 06 basis points and 01 basis point respectively to 9.69% and 10.48%, while all bids received for the 91 day maturity were rejected.

In the secondary bill market, April 2017 and June 2017 bills were seen quoted at levels of 10.10/35 and 10.55/60 respectively.

Meanwhile in money markets, the injection of liquidity by way of an overnight reverse repo auction amounting to Rs.45.00 billion at a weighted average rate of 8.30% by the Open Market Operations (OMO) Department of the Central Bank, resulted in the weighted averages of overnight call money and repo rates remaining at 8.40% and 8.61%.

The liquidity in the system stood at a net deficit of Rs.46.74 billion with a further amount of Rs.14.67 billion being accessed from the Standard Lending Facility at a rate of 8.50% (SLFR) while, an amount of Rs.12.94 Billion was deposited with the Central Bank at the Standing Deposit Facility Rate (SDFR) of 7.00%.

Rupee appreciates marginally

Meanwhile in Forex markets, the rupee on one week forward contracts appreciated marginally to close the day at Rs.146.10/15 against the previous day’s closing levels of Rs.146.20/35.

The total USD/LKR traded volume for 1 August was $ 76.25 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 146.85/00; three months – 148.40/60; and six months – 150.80/00.