Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 1 March 2016 00:11 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

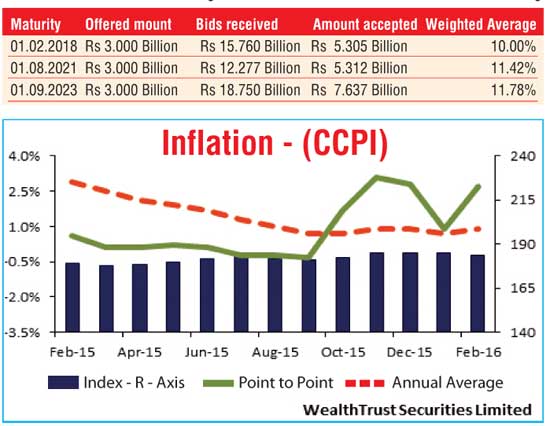

The first round of bond auctions conducted yesterday following the policy rate hike saw its weighted averages increase close to secondary market levels as the total accepted amount on all three maturities exceeded the total offered amount of Rs. 9 billion by a  further Rs. 9.2 billion. The 1.11 year, 5.05 year and 7.06 year maturities of 01.02.2018, 01.08.2021 and 01.09.2023 were seen recording weighted averages of 10.00%, 11.42% and 11.78% respectively.

further Rs. 9.2 billion. The 1.11 year, 5.05 year and 7.06 year maturities of 01.02.2018, 01.08.2021 and 01.09.2023 were seen recording weighted averages of 10.00%, 11.42% and 11.78% respectively.

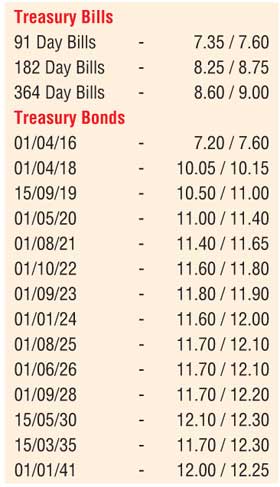

In secondary bond markets, activity was witnessed on the auctioned 01.09.2023 maturity within a daily low of 11.65% to a high of 11.85% while on the long end of the curve, the 15.05.2030 maturity was seen changing hands within the range of 12.15% to 12.20%. In addition, a limited amount of activity was witnessed on the 01.04.2018 maturity within the range of 10.05% to 10.15% as two way quotes on the rest of the yield curve increased as well. Meanwhile, Inflation for the month of February reflected an increase on its point to point to 2.70% against its previous month of 0.9% while the annual average also increased to 0.9% from 0.70%.

Meanwhile in money markets, the overnight call money and repo rates increased marginally to average 7.51% and 6.97% respectively as surplus liquidity stood at Rs. 47.74 billion yesterday.

Rupee depreciates further

The spot as well as one week forward contracts were seen dipping further yesterday to close the day at Rs.144.50/70 and Rs.144.80/00 respectively against its previous day’s closing of Rs.144.40/55 and Rs.144.70/80 in Forex markets on the back of continued importer demand. The total USD/LKR traded volume for 26 February was US $ 69.30 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 145.40/80; 3 Months - 146.75/25 and 6 Months - 148.90/30.