Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 27 June 2016 00:00 - - {{hitsCtrl.values.hits}}

Softlogic Holdings Plc and Fairfax Asia last week established a key partnership. Here officials of Asian Alliance Insurance PLC, Asian Alliance General Insurance Ltd., and Fairfax Asia following the signing of the agreement.

Softlogic Holdings Plc and Fairfax Asia last week established a key partnership. Here officials of Asian Alliance Insurance PLC, Asian Alliance General Insurance Ltd., and Fairfax Asia following the signing of the agreement.

By Wealth Trust Securities

The Central Bank of Sri Lanka held policy rates steady for a fourth consecutive month at its meeting held on Friday, 24 June.

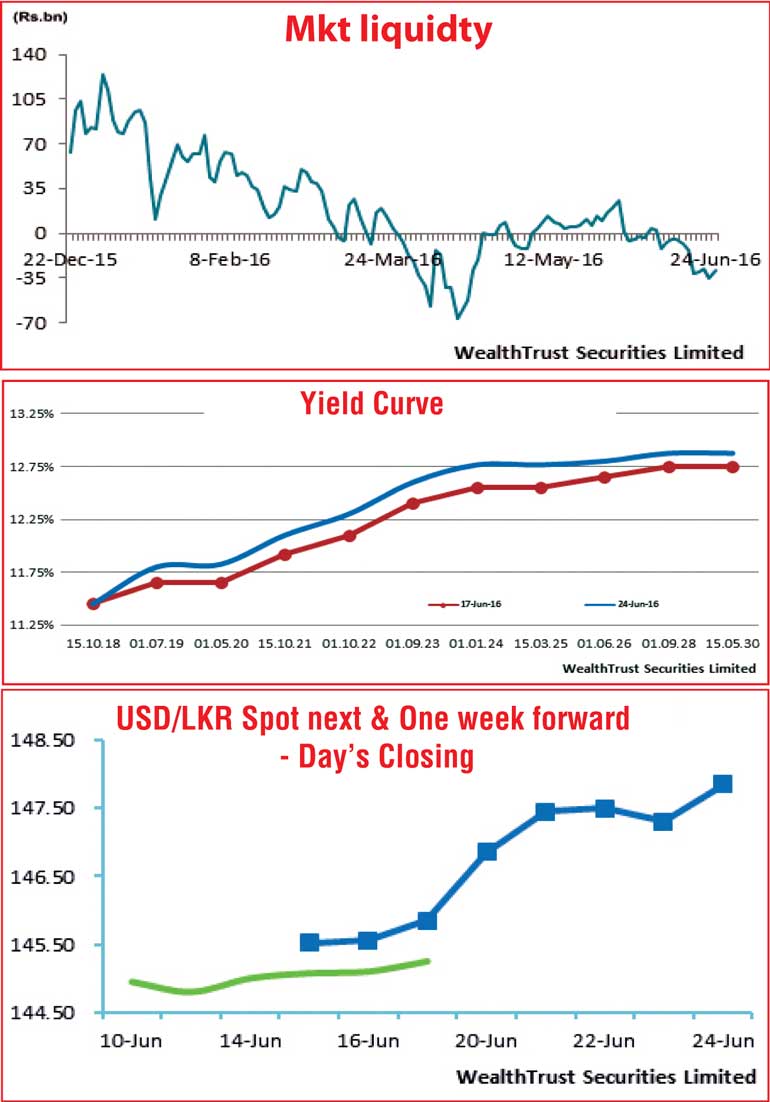

In secondary bond markets, the yield curve reflected a parallel shift upwards for a second consecutive week during the week ending 24 June driven by the announcement of four Treasury bond auctions, speculation on the outcome of the Monitory policy announcement, an increase in the weekly averages for a sixth consecutive week and UK’s exit from the European union or Brexit becoming a reality against expectations.

In secondary bond markets, the yield curve reflected a parallel shift upwards for a second consecutive week during the week ending 24 June driven by the announcement of four Treasury bond auctions, speculation on the outcome of the Monitory policy announcement, an increase in the weekly averages for a sixth consecutive week and UK’s exit from the European union or Brexit becoming a reality against expectations.

The liquid maturities of 01.05.20, 15.10.21, 01.01.24 and 01.06.26 were seen increasing to weekly highs of 11.85%, 12.17%, 12.80% and 12.87% respectively against its previous weeks closing levels of 11.60/70, 11.91/93, 12.53/57 and 12.60/70. In addition, the maturities of 15.10.2018 and 01.10.2022 were seen hanging hands within the range of 11.35% to 11.50% and 12.20% to 12.30% as well during the week.

Today’s Treasury bond auctions in lieu of Rs.46.8 billion in coupons due on 1 July will have Rs.7 billion each on a 2.10 year maturity of 01.05.2019 and a 6.03 year maturity of 01.10.2022, a further Rs.10 billion on a 4.05 year maturity of 15.12.2020 and Rs.8 billion on a 8.08 year maturity of 15.03.2025. Meanwhile the foreign holding in Rupee bonds was seen increasing during the week ending 22nd June by a further Rs.7.1 billion, recording a total inflow of Rs.21.95 billion over the past three weeks.

Meanwhile in money markets, despite the net liquidity shortage in the system increasing to a two month low of Rs.35.4 billion during the week, the overnight call money and repo rates remained mostly unchanged to average at 8.18% and 8.05% respectively due to the OMO (Open Market Operation) department of Central Bank injecting liquidity throughout the week at weighted averages ranging from 7.96% to 7.97% on an overnight basis.

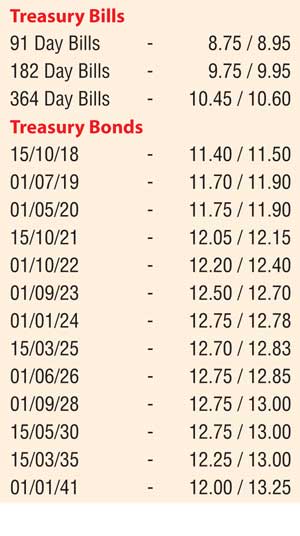

Rupee dips during the week

The USD/LKR rate on its one week forward contract depreciated during the week to a low of Rs.148.50 during the week against its previous weeks closing of Rs. 145.60/10 on the back of importer demand before gaining marginally to close the week at Rs.147.80/00. The daily USD/LKR average traded volume for the first four days of the week stood at $ 76.16 million.

Some of the forward dollar rates that prevailed in the market were: one month – 148.20/30; three months – 149.80/00; and six months – 152.00/20.