Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 16 May 2016 00:00 - - {{hitsCtrl.values.hits}}

Foreign holding in rupee bonds increases once again

Foreign holding in rupee bonds increases once again

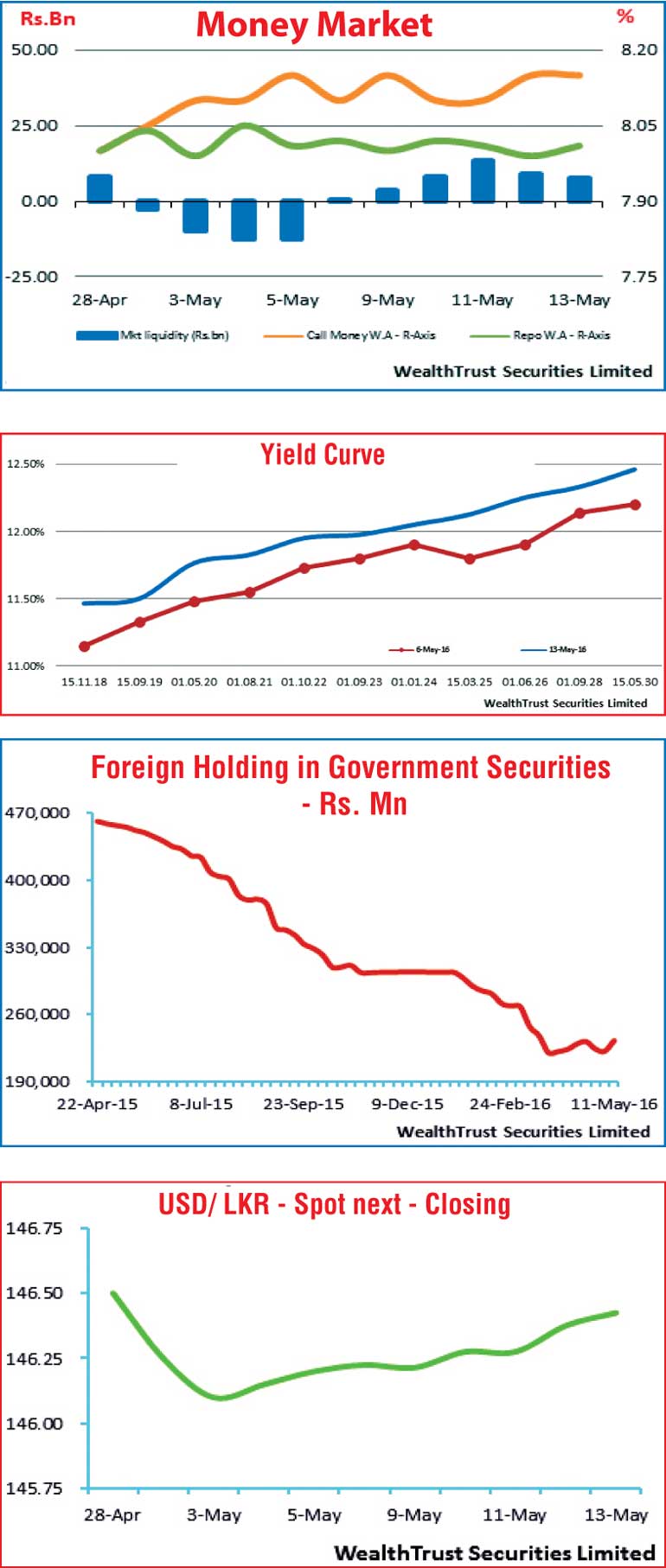

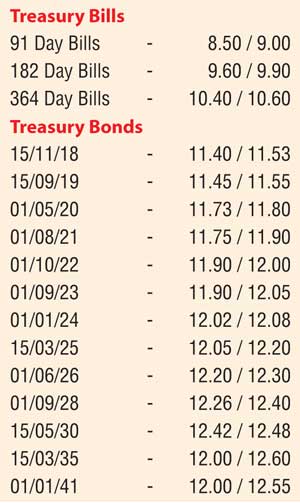

By Wealth Trust Securities

The secondary market bond yields were seen increasing across the yield curve during the week ending 13 May, driven by the outcome of the primary Treasury bill and bond auctions. Activity centred across the curve as volumes changing hands remained high. On the short end of the curve, the 15.11.2018 and 01.05.2020 maturities were seen changing hands within weekly lows of 11.27% and 11.45% respectively to highs of 11.45% and 11.80% while on the belly end of the curve, the 01.10.2022 and 01.01.2024 changed hands within lows of 11.80% and 11.98% to highs of 11.90% to 12.04%.

On the long end of the curve, activity centred on the 01.06.2026, 01.09.2028 and 15.05.2030 maturities within weekly lows of 12.05%, 12.15% and 12.20% respectively to highs of 12.25%, 12.30% and 12.45% with the overall yield curve reflecting a parallel shift upwards week on week.

Meanwhile the foreign holding in rupee bonds was seen increasing once again to record an inflow of Rs. 11 billion for the week ending 11 May, reversing its previous two weeks outflows. Meanwhile in money markets, overnight call money and repo rates averaged at 8.13% and 8.01% respectively for the week as the net surplus liquidity increased during the week to average Rs. 8.34 billion against its previous week’s average deficit of Rs. 8.62 billion.

Rupee depreciates during the week

The USD/LKR rate on the active spot next contract depreciated during the week to close the week at Rs. 146.40/45 against its previous weeks closing levels of Rs. 146.15/25 on the back of continued importer demand.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 75.83 million.

Some of the forward dollar rates that prevailed in the market were one month – 147.15/30; three months – 148.70/90 and six months – 150.90/10.