Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 16 November 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

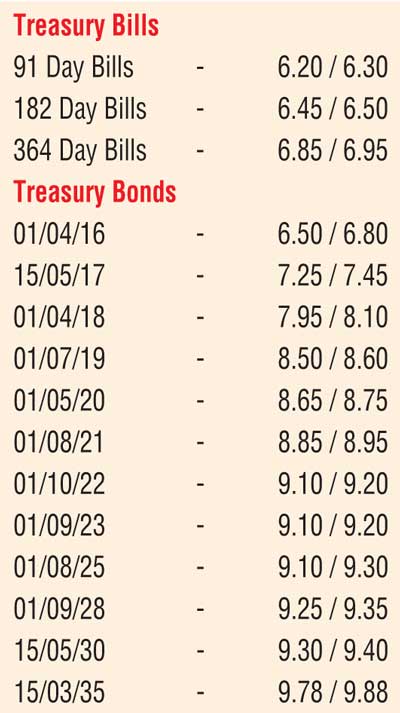

The week ending 13 November saw the secondary market bond yield curve move up, reversing a downward trend witnessed over the previous four weeks. Selling interest from the beginning of the week mainly on the belly end of the curve saw yields on the liquid maturities of 15.09.19, 01.05.20, 01.08.21, 01.07.22, 01.10.22 and 01.09.23 move up to weekly highs of 8.65%, 8.78%, 8.95%, 9.30%, 9.20% and 9.15% respectively against its weeks opening lows of 8.50%, 8.60%, 8.82%, 9.05%, 9.05%, 9.00% and 9.10%.

This was despite the weighted average on the 364 day bill decreasing for a fifth consecutive week at its weekly Treasury bill auction while all bids for the 182 day bill were rejected.

However, buying interest towards the latter part of the week curtailed the upward movement as yields were seen dipping from its weekly highs but still reflected week on week increases of 15 basis points (bp) on the 2019, 19 bp on the 2020, 14 bp on the 2021, 20 bp on the 2022 and 23 bp on the 2023 to reflect an parallel shift upward of the yield curve. In addition on the long end of the yield curve 2028, 2030 and 2035 maturities were seen changing hands within the range of 9.30% to 9.45%, 9.35% to 9.75% and 9.80% to 9.95% respectively.

Meanwhile demand for secondary market bills saw durations centring the 91, 182 and 364 day maturities change hands within the range of 6.20% to 6.35%, 6.40% to 6.50% and 6.80% to 6.90% post auction.

Meanwhile in money markets, overnight call money and repo rates remained steady throughout the week to average 6.31% and 6.09% respectively as surplus liquidity remained high to average Rs. 116.19 billion.

Rupee continues to slide

The USD/LKR rate on spot contracts was seen depreciating throughout the week to hit a new low of Rs. 142.30 on the back of continued importer demand and closed the week marginally higher at Rs. 142.00/20. The daily average USD/LKR traded volumes for the first three days of the week stood at $ 65.10 million.

Some of the forward dollar rates that prevailed in the market were one month – 142.40/50; three months – 143.15/25 and six months – 144.40/55.