Friday Feb 27, 2026

Friday Feb 27, 2026

Wednesday, 10 June 2015 00:11 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

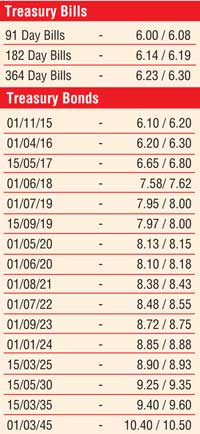

The outcome of the Treasury Bond auction yesterday, at where the 4.10 year maturity of 1 May 2020 and the 7.03 year maturity of 1 October 2022 recorded a weighted averages of 8.11% and 8.56% respectively while all bids for the 9.09 year maturity of 15 March 2025 was rejected, led to a bag of mixed outcomes in secondary Bond markets.

At the auction, demand for the 4.10 year and 7.03 year maturities saw the total accepted amount exceed the total offered amount by Rs. 5.60 billion.

As has been the trend in secondary Bond markets over the past few weeks, yields on the longer end of the curve continued to decline while yields on the belly end of the curve increased marginally on the back of considerable volumes changing hands.

Buying interest on the auctioned maturity of 15 March 2025 saw its yields dip to an intraday low of 8.90% against a high of 8.94% while the 20-year maturity of 15 March 2035 and the 30-year maturity of 1 March 2045 were seen changing hands at levels of 9.55% and 10.50% respectively.

However, selling interest on the liquid maturities of 1 June 2018, 15 September 2019, 1 July 2022 and 1 September 2023 saw its yields increase to intraday highs of 7.60%, 8.03%, 8.52% and 8.75% respectively against its days opening lows of 7.56%, 7.97%, 8.50% and 8.71%.

Meanwhile, today’s weekly Treasury Bill auction will have on offer an total amount of Rs. 22 b, consisting of Rs. 5 b on the 91 day Bill, Rs. 7 b on the 182 day Bill and Rs. 10 b on the 364 day Bill. At last week’s auction, weighted averages remained unchanged at 6.07%, 6.18% and 6.31% respectively for the first time in eight weeks against a downward trend witnessed previously. Meanwhile, in money markets yesterday, overnight call money and repo rates remained steady to average at 6.11% and 5.81% respectively as surplus liquidity stood at Rs. 91.13 billion.

Rupee appreciates further

The rupee on spot contracts was seen gaining to a high of Rs. 133.80 yesterday while active three month forward contracts were seen appreciating as well to close the day at levels of Rs.135.40/70. The total USD/LKR traded volume on 8 June stood at $ 89.15 million.

Reuters: The stock index fell for the second straight session on Tuesday to close at its lowest in more than seven weeks, with turnover slumping to a near three-month low as concerns over political uncertainty dented demand for risky assets.

President Maithripala Sirisena’s Government has said it would dissolve Parliament once some crucial reforms including an electoral bill are passed, but has yet to fix a date for the election.

The main stock index ended down 0.16% at 7,067.11, slipping to its lowest closing level since 15 April.

“Elections might be the triggering point. There is no buying and it’ll be like this till the announcement of the elections,” said Dimantha Mathew, Research Manager at First Capital Equities Ltd.

Some stockbrokers said investors were waiting for the right moment, and sellers were not ready to dispose of holdings at low prices given the lack of buying interest.

Turnover was Rs. 328.8 million ($2.46 million), the lowest since 13 March and well below this year’s daily average of about Rs. 1.11 billion.

Analysts said foreign investors have been selling shares amid expectations the US would hike key interest rates sooner than later. An upbeat US nonfarm payrolls in May, the largest gain since December, has raised chances for a rate hike as early as September.

Foreign investors sold a net Rs. 6.9 million ($51,608) worth of shares, extending net foreign outflow to Rs. 1.52 billion worth shares in the past 10 sessions.

The Bourse, however, has seen net inflows of Rs. 4.42 billion in equities so far this year.

Political uncertainty due to the Ranil Wickremesinghe-led coalition Government not having a parliament majority has been a drag on the market, though the trend reversed after the Central Bank cut key monetary policy rates to record lows on 15 April.

Stockbrokers said better corporate earnings would help the market gain.

Shares in Ceylon Tobacco Company Plc eased 2.64% while Nestle Lanka Plc fell 2.27%.

Reuters: The rupee ended slightly firmer on Tuesday after a State-run bank sold dollars at 133.80, cutting the spot rupee’s level by 10 cents from the previous session, dealers said.

The spot currency traded at 133.80 compared with Monday’s close of 133.90 as a State bank, through which the Central Bank usually directs the market, sold dollars at Rs. 133.80.

“The State bank offered dollars at 133.80. Forwards were not trading as a State bank sold dollars in the spot trade,” a currency dealer said asking not to be named. The State-run bank sold dollars at 133.90 during the last five sessions through Monday to hold the rupee steady despite downward pressure due to tepid dollar sales by exporters amid concerns over the continuing political uncertainty, dealers said.

One-week forwards were bid at 133.95 per dollar and there were no offers compared with Monday’s close of 134.20/30, while three-month forwards, which have been actively trading over the last few weeks in the absence of spot, ended at 135.50/136.00 per dollar compared with Monday’s close of 135.75/136.00. Dealers said exporters may start selling dollars as inflows from the dollar bond sale would help boost the rupee. Exporters have been reluctant to convert dollars into local currency as it is cheaper to manage costs with rupee loans in a lower interest rate environment.