Saturday Feb 28, 2026

Saturday Feb 28, 2026

Monday, 29 February 2016 00:00 - - {{hitsCtrl.values.hits}}

The bank closed the year 31 December 2015 with a post-tax profit of Rs. 2,614 million, up by 3% over the previous year. The post tax profit for the quarter was up by 21% mainly owing to lower impairment charges compared to the corresponding period last year. Profit for the year was unfavourably impacted due to marked to market losses made on the FIS portfolio and the one off provision booked for specific facilities in the first quarter. Excluding these, the bank’s core business performed commendably with a post tax profit growth of 16% underpinned by strong volume growth in loans and advances together with a reduction in impairment charges which somewhat offset the impact of narrowing NIMs.

The bank closed the year 31 December 2015 with a post-tax profit of Rs. 2,614 million, up by 3% over the previous year. The post tax profit for the quarter was up by 21% mainly owing to lower impairment charges compared to the corresponding period last year. Profit for the year was unfavourably impacted due to marked to market losses made on the FIS portfolio and the one off provision booked for specific facilities in the first quarter. Excluding these, the bank’s core business performed commendably with a post tax profit growth of 16% underpinned by strong volume growth in loans and advances together with a reduction in impairment charges which somewhat offset the impact of narrowing NIMs.

Credit growth was subdued during the first half of 2015, recovering only towards the latter part of the year as sentiment improved. Loans and advances portfolio recorded a growth of 23% with deposits recording a growth of 16% during the year.

The Group’s net interest income growth moderated to 2% during the year, reflective of declining yields in several business lines amidst rising cost of funds and intensified competitive pressures. The bank aggressively pursued strategies to grow CASA to keep cost of funds low. Low cost deposits recorded a 13% growth with the CASA mix improving to 32% of deposits. Net fee and commission income recorded a growth of 15% primarily driven by growth in credit card business income and transactional fees. In trade services, the bank successfully pursued a strategy of penetrating trade hubs resulting in trade related fees growing by 23% during the period. The bank’s net trading income recorded a decline in comparison to previous year due to unfavourable interest rate movements which resulted in marked to market losses on the FIS portfolio. Customer forex income recorded strong growth of 50% underpinned by incremental customer volumes.

Total impairment charges for the period declined to Rs. 985.5 million, largely due to a significant reduction in collective impairment. This improvement reflects the bank’s emphasis on quality loan growth and substantial improvements in collection efforts during the year. Individual impairment increased in comparison to the previous year, due to a one-off charge on specific facilities which have been fully provided for. Overall, the bank made significant improvements in portfolio quality in several key business lines including leasing, credit cards and SME which is reflected in NPL ratio improving to 2.8% in 2015 from 4.2% in the previous year.

The ongoing focus on lean initiatives and workflow methods together with increased automation and more reliance on digital channels enabled the Group to contain the increase in operating expenses to 8% during the year. Personnel expenses grew by 7% as 133 employees were added to our team during the year. Depreciation and amortisation expenses grew by 25% largely due to increased charges on the bank’s core banking system which was launched in 2014. Overall, the Group’s cost to income ratio declined from 52% to 55% largely owing to lower growth in revenue arising from narrowing NIMs. The capital position was sound at Rs. 17.8 billion with Capital Adequacy Ratios both at Tier 1 and 2 maintained at comfortable levels.

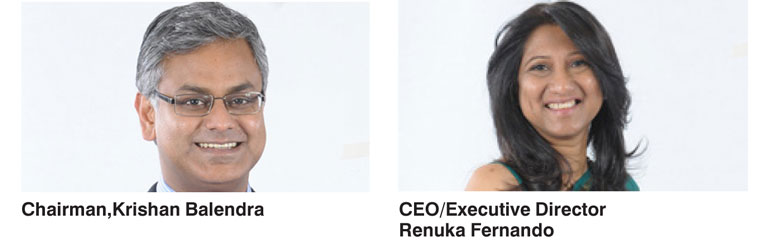

Commenting on the results and achievements, CEO/Executive Director Renuka Fernando stated, “The solid foundation established in 2015 would support strong growth anticipated in 2016 as the macro economic outlook remains positive. We will continue to break new ground as we embrace the digital frontier, enhancing customer experience and reducing complexity of doing business. People continue to be our biggest strength and we believe that the development and retention of our talent is vital. We remain committed in delivering sustainable returns to all our stakeholders and look forward to yet another exciting year.”

Nations Trust Bank PLC is ranked among the top 25 business establishments in Sri Lanka by Business Today magazine and its market positioning of being the benchmark of customer convenience, is ably supported by a host of financial products and services offered to a wide range of customers. The bank operates 92 branches across the country with an ATM network that covers 130 locations and is the issuer and sole acquirer for American Express Cards in Sri Lanka.