Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 21 August 2015 00:21 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

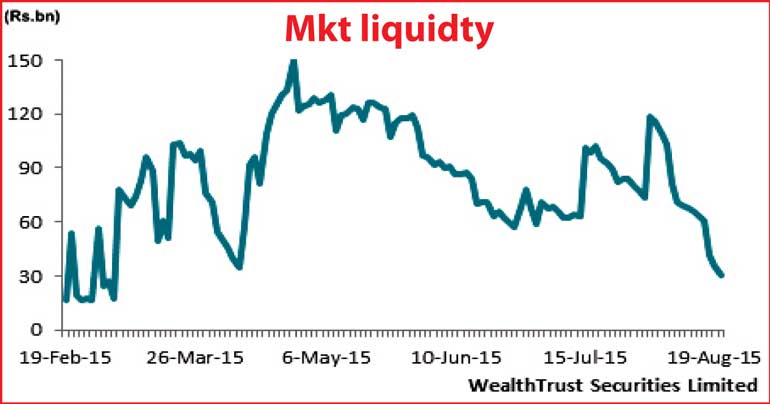

The prevailing tight liquidity situation in money markets was given a breather yesterday as the Open Market Operations (OMO) Department of Central Bank was seen infusing an amount of Rs. 7.16 billion on an overnight basis, at a weighted average of 6.20%, by way of a reverse repo auction, the first of such since March 2014.

This in turn curtailed the upward trend in overnight call money and repo rates to average 6.28% and 6.47% respectively as surplus liquidity dipped further to over a five month low Rs. 30.11 billion yesterday.

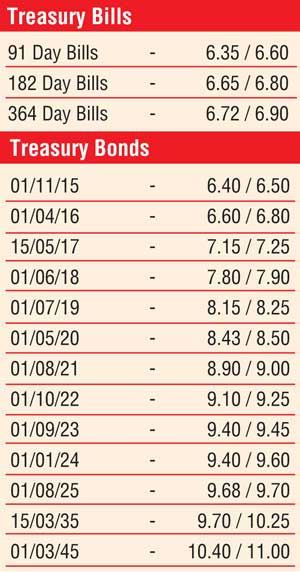

Nevertheless, the upward trend in secondary market bond yields continued for a second consecutive day as selling interest on the 01.05.2020, 01.08.2021, 01.09.2023 and 01.08.2025 maturities saw its yields increase to intraday highs of 8.45%, 8.90%, 9.40% and 9.70% respectively, while on the shorter end of the yield curve, bond durations around the one year maturity were seen changing hands within the range of 6.90% to 7.10%.

Rupee remains stable

The USD/LKR rate on spot contracts remained stable to close the day at Rs. 133.90 yesterday. The total USD/LKR traded volume for 19 August 2015 was US $ 97.52 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 134.54/64; three months - 135.74/84 and six months - 137.58/68.

Reuters: The rupee ended steady in thin trade on Thursday amid importer dollar demand, as a state-owned bank kept its dollar-selling rate flat at 133.90.

On Wednesday, the bank had reduced the currency’s peg against the dollar by 10 cents to allow the exchange rate to appreciate to 133.90. The rupee ended steady at 133.90 per dollar on Thursday.

Currency dealers said the central bank offered a Rs. 30-billion reverse repo auction to absorb excess liquidity from the market, a move seen to prevent imports and depreciation pressure on the local currency.

The Central Bank later accepted Rs. 7.1 billion at 6.19%, dealers said.

“The Central Bank offered a reverse repo auction for the first time since March 2014. This is to absorb the excess liquidity to arrest the import pressure,” said a currency dealer asking not to be named.

The market had expected the central bank to allow a slight depreciation in the rupee, in line with other regional currencies that have declined against the dollar.

The market expects some business-friendly economic policies and more dollar inflows after the centre-right United National Party (UNP) won Monday’s parliamentary election.

Prime Minister Ranil Wickremesinghe’s UNP is expected to form a stable government along with President Maithripala Sirisena’s centre-left Sri Lanka Freedom Party (SLFP) to revive stalled reforms to make the Government more open and accountable.