Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 1 November 2016 00:44 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The dull sentiment experienced in the secondary bond market continued yesterday as well, with limited trades consisting of the 01.04.18 and 01.03.21 maturities taking place at levels of 11.00% and 11.76% respectively.

Two-way quotes for other maturities remained broadly steady in comparison with the previous trading day’s closing levels.

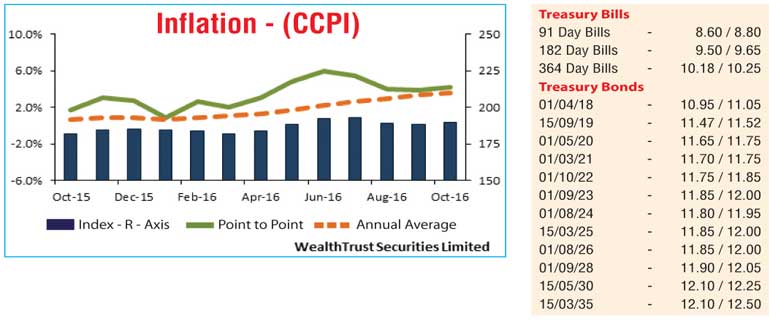

In the meantime, inflation for the month of October was seen increasing once again to 4.2% on the point to point while its annual average increased to a two-year high of 3.6%. This was ahead of the monetary policy announcement for October which was due at 7.00 p.m. yesterday.

The Monetary Board kept the policy rates steady at its meeting last month following a 50 basis points increase in July.

In the money market, overnight call money and repo rates remained mostly unchanged to average 8.42% and 8.66% respectively as the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka injected an amount of Rs. 21.00 billion on an overnight basis by way of a Reverse Repo auction at a W. Avg of 8.50%. The net deficit in the system stood at Rs. 24.88 billion.

The USD/LKR rate on one week forward contracts remained mostly unchanged to close the day at Rs. 148.30/50. The total USD/LKR traded volume for 28 October 2016 was $ 65.00 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 148.90/30; 3 Months - 150.60/00 and 6 Months - 153.10/50.