Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 16 February 2016 00:17 - - {{hitsCtrl.values.hits}}

Reuters: Global banking giant HSBC Holdings has decided to keep its headquarters in Britain, rejecting the option of shifting its centre of gravity back to its main profit-generating hub Hong Kong after a thorough 10-month review.

The decision by HSBC’s board, which the bank said was unanimous, gives a boost to London’s status as a global financial centre, under threat since the financial crisis of 2008-09 from tougher regulation and rising costs.

For Hong Kong, the chance of luring Europe’s biggest bank back to its birthplace and to the heart of its Asian growth strategy has been lost for now.

“London is one of the world’s leading international financial centres and home to a large pool of highly skilled, international talent,” HSBC said in a statement on Sunday after a board meeting in London.

“London is one of the world’s leading international financial centres and home to a large pool of highly skilled, international talent,” HSBC said in a statement on Sunday after a board meeting in London.

“It remains therefore ideally positioned to be the home base for a global financial institution such as HSBC.”

Analysts estimated the cost of moving out of London at $ 1.5 billion to $ 2.5 billion, a hefty bill to swallow unless HSBC was going to get clear tax and regulatory advantages.

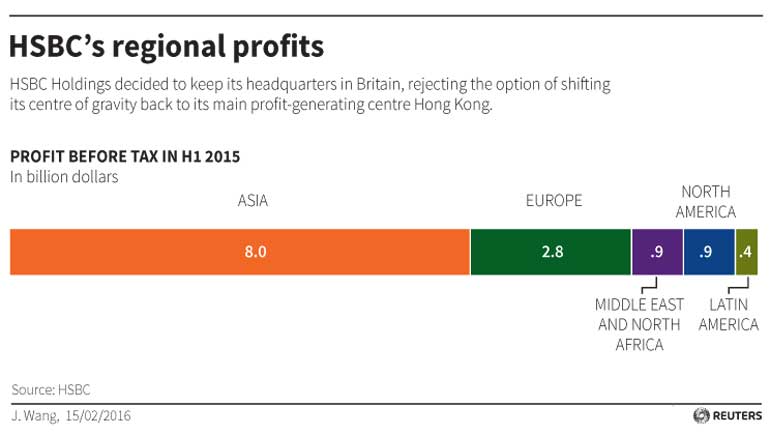

London, however, could face soon a potentially disruptive challenge if Britain were to vote to leave the European Union in a highly unpredictable referendum. Hong Kong, where HSBC was founded about 150 years ago and where it employs more than 20,000, was considered the strongest candidate for a possible move as it accounts for 46% of HSBC’s pre-tax profit.

London, however, could face soon a potentially disruptive challenge if Britain were to vote to leave the European Union in a highly unpredictable referendum. Hong Kong, where HSBC was founded about 150 years ago and where it employs more than 20,000, was considered the strongest candidate for a possible move as it accounts for 46% of HSBC’s pre-tax profit.

But gyrations in Chinese markets coupled with concerns about China’s growing influence over Hong Kong meant it was seen as increasingly likely in recent months that the bank would stick to London.

HSBC stressed it remained committed to its Asia ‘Pivot’ strategy under which it plans to invest more into China’s Pearl River Delta, an industrial region of more than 42 million people north of Hong Kong which already accounts for half of HSBC’s China revenues. “Having our headquarters in the UK and our significant business in Asia Pacific delivers the best of both worlds to our stakeholders,” CEO Stuart Gulliver said in the statement. The Hong Kong Monetary Authority, which had earlier said it would welcome an HSBC move to Hong Kong, said it respected the board’s decision to maintain the status quo. “The anticipated potential boost to Hong Kong’s economy from relocated jobs will not materialise now,” said Binay Chandgothia, managing director at Hong Kong-based asset manager Principal Global Investors. “As far as the China strategy goes, the relocation decision would really not impact it much. Their Asian headquarters remain in Hong Kong so HSBC can easily continue to execute as in the past.”

Some investors had encouraged HSBC to consider leaving Britain, partly because of a tax on banks’ global balance sheets brought in after the financial crisis. But in July, finance minister George Osborne scaled back the tax as part of efforts to help to keep Britain a ‘highly attractive’ place for banks.

A Reuters analysis showed that moving to Hong Kong might have actually increased the bank’s tax burden.