Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 22 August 2016 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

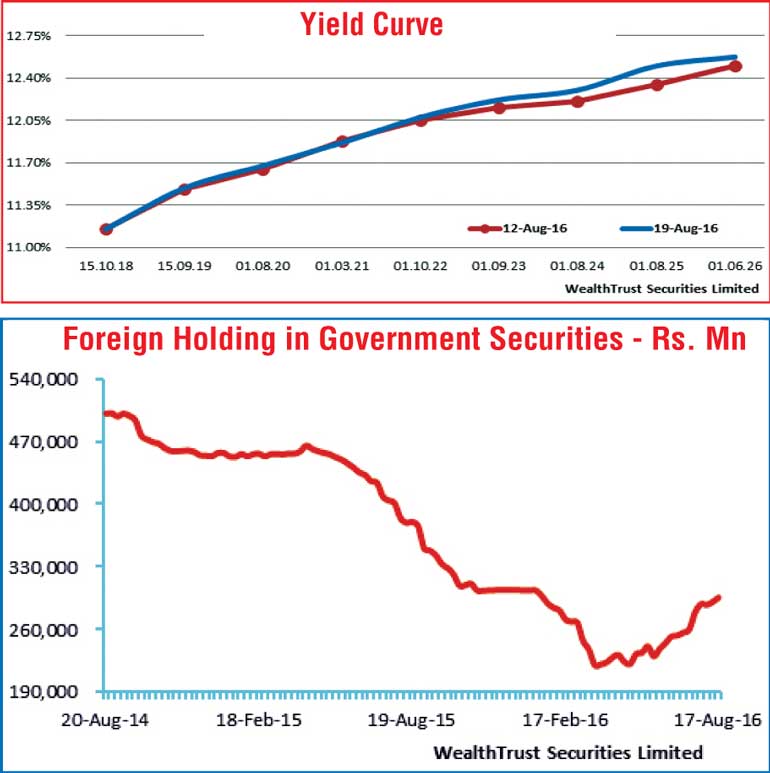

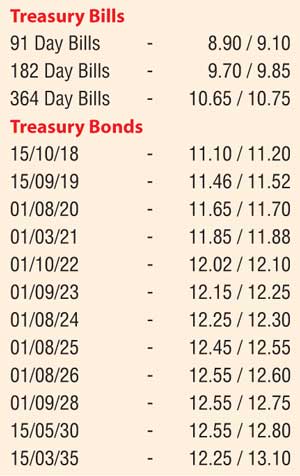

The secondary bond market witnessed a mixed outcome during the week ending 19 August with yields of the mid to long term maturities increasing and the yields of the short term maturities declining towards the latter part of the week. The liquid maturities of 01.09.23, 01.08.24, 01.08.25 and the two 2026’s (i.e. 01.06.26 and 01.08.26) saw their yields increasing to weekly highs of 12.20%,12.26%, 12.50%, 12.56% and 12.58% respectively in comparison with the previous weeks closing levels of 12.13/18, 12.18/23, 12.30/40, 12.48/52 and 12.48/54.

This upward momentum was also witnessed on the short-term maturities of 15.09.19 and 01.03.21 during the early part of the week with their yields hitting weekly highs of 11.53% and 11.94%. Furthermore, the weighted averages at the weekly Treasury bill auction too were seen increasing marginally on the 182 day and 364 day maturities.

However, foreign buying interest of selected maturities coupled with an increase in market liquidity resulted in the yields of the shorter maturities declining towards the later part of the week to close the week on a steady note when compared against the previous weeks closing levels.

The foreign holding of Rupee denominated bonds was seen increasing by a further Rs. 4.83 billion during the week ending 16 August to Rs. 295.71 billion, a level last seen in January 2016.

In money markets, liquidity improved towards the later part of the week while the OMO (Open Market Operation) Department of the Central Bank injected liquidity on an overnight basis throughout the week at weighted averages ranging from 8.34% to 8.39%. The overnight call money and repo rates remained mostly unchanged to average at 8.40% and 8.47% respectively.

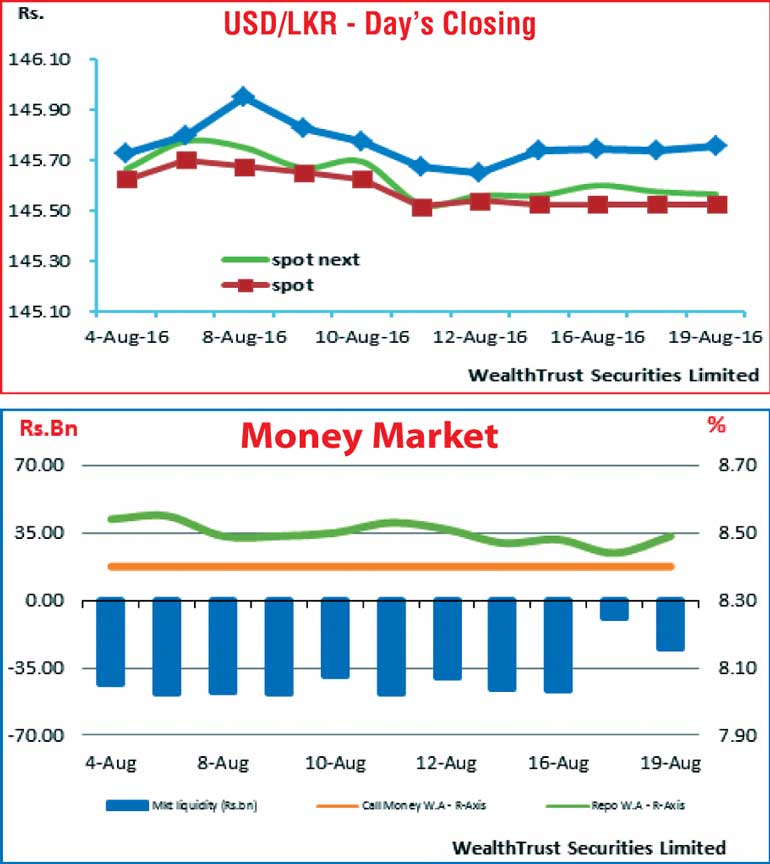

Rupee remains steady during the week

The rupee on spot, spot next and one week forward contracts remained steady throughout the week to close the week at Rs. 145.50/55, Rs. 145.53/60 and Rs. 145.73/78 respectively.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 61.75 million.

Some of the forward dollar rates that prevailed in the market were one month – 146.35/50; three months – 148.00/15 and six months – 150.50/70.