Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 25 July 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

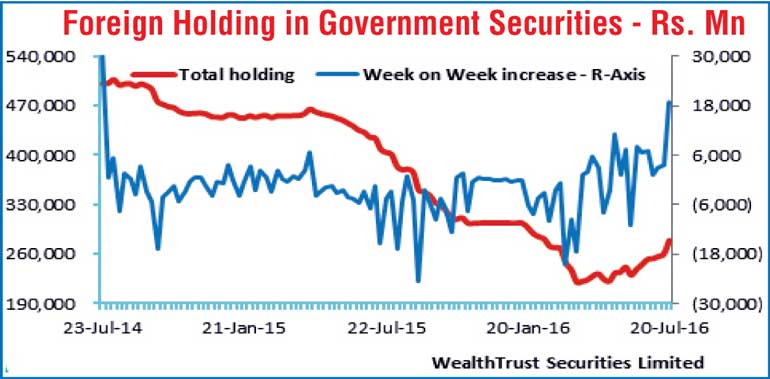

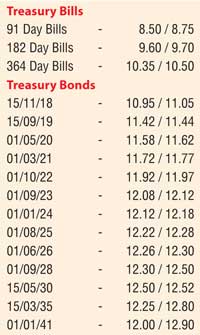

The foreign buying in to rupee bonds for the week ending 20 July, peaked to a two-year high of Rs. 19 billion on a week on week  basis. This was reflected with them investing in mainly the shorter liquid maturities of 15.11.18, 15.09.19, 01.05.20, 01.03.21 and 01.10.22, as a result pushing the yields to intraweek lows of 10.95%, 11.43%, and 11.60%, 11.74% and 11.94% respectively. This was in comparison to the previous week’s closing levels of 11.05/15, 11.40/50, 11.55/70, 11.75/83 and 11.95/03.

basis. This was reflected with them investing in mainly the shorter liquid maturities of 15.11.18, 15.09.19, 01.05.20, 01.03.21 and 01.10.22, as a result pushing the yields to intraweek lows of 10.95%, 11.43%, and 11.60%, 11.74% and 11.94% respectively. This was in comparison to the previous week’s closing levels of 11.05/15, 11.40/50, 11.55/70, 11.75/83 and 11.95/03.

The decline in yields of the shorter end of the yield curve was also witnessed at the weekly Treasury bill primary auction where the weighted averages of the 91 day and 182 day maturities dropped to seven week lows of 8.80% and 9.75%. Subsequent to the auction, the secondary bill market too was relatively active with January 2017 bills changing hands within the range of 9.60% to 9.70% and April 2017 bills within the range of 9.95% to 10.10%.

However, the market witnessed selling interest of the longer maturities consisting of 01.09.23, 01.01.24, the two 2025’s (i.e. 15.03.25 and 01.08.25) and 01.06.26 with their yields increasing to intra week highs of 12.12%, 12.15%, 12.25% each and 12.28% respectively against the previous week’s closing levels of 12.02/07, 12.08/12, 12.10/18 each and 12.20/26

In the money market, the net liquidity shortfall dipped towards the later part to close the week at Rs. 41.82 billion in comparison to last week’s level of Rs. 50.32 billion with Call money and repo rates averaging 8.23% and 8.09% respectively. The OMO (Open Market Operations) department of Central Bank infused liquidity throughout the week by way of overnight reverse repo auctions.

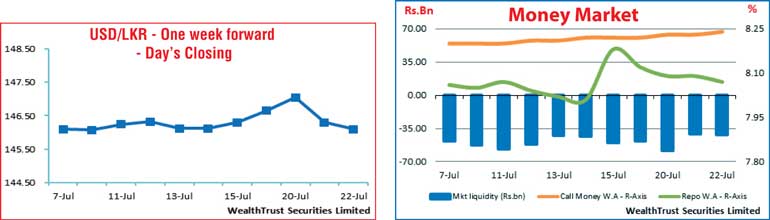

Rupee fluctuates during the week

The rupee on active one week forward contracts was seen closing the week at levels of Rs. 146.00/20 against its previous weeks closing levels of Rs. 146.25/35 subsequent to hitting levels of Rs. 146.95/15.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 72.74 million.

Some of the forward dollar rates that prevailed in the market were one month – 146.90/00; three months – 148.55/65 and six months – 150.60/70.