Monday Mar 09, 2026

Monday Mar 09, 2026

Wednesday, 26 August 2015 00:00 - - {{hitsCtrl.values.hits}}

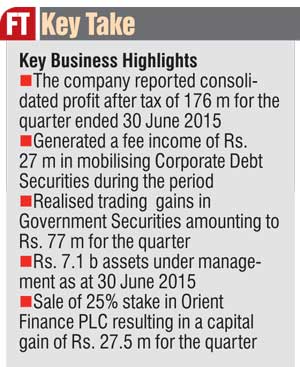

First Capital Holdings PLC recorded a consolidated profit after tax of Rs. 176 million for the quarter ended 30 June 2015.

Consequent to the policy rate reductions in April the company’s structuring and placement arm First Capital Ltd., which specialises in mobilised listed debentures, asset backed securitisations and commercial papers, successfully generated a fee income of Rs. 27 million during the period under review (2014/15 – Rs. 13 million); while the group’s primary dealer First Capital Treasuries Ltd.  realised a trading gain of Rs. 77 million for the quarter, capitalising on prevailing market conditions.

realised a trading gain of Rs. 77 million for the quarter, capitalising on prevailing market conditions.

“While we are pleased with our performance to date, we seek to transform the prevailing macro-economic factors to our favour. The Group will continue to build on the current growth momentum across all its subsidiary businesses while expanding on corporate advisory and broader investment banking services,” said Dilshan Wirasekara, highlighting the Group’s vision of becoming Sri Lanka’s leading investment bank and its performance thus far.

Meanwhile during the first half of the financial year 2015/16, the group’s Wealth Management and Unit Trust, First Capital Asset Management Ltd., reflected a growth of Rs. 2.9 billion, increasing the division’s total assets under management to Rs. 7.1 billion. With a return of 13.13% for the year ended 30 June, First Capital Wealth Fund continuing its steady performance.

Consistent with the mixed performance of the Colombo Stock Market, as foreign participants exited the market due to political  uncertainty the Stock broking division First Capital Equities Ltd., saw lower trading volumes resulting in lower broking income.

uncertainty the Stock broking division First Capital Equities Ltd., saw lower trading volumes resulting in lower broking income.

Furthermore the company divested its 25% stake in Orient Finance PLC resulting in a capital gain of Rs. 27.5 million for the quarter. The investment realised a total gain of Rs. 260.8 million, including gains recorded in the previous financial year amounting to Rs. 233.3 million.

“The Group will continue to engage actively with its customers and use the leadership position and reputation it has established in the marketplace to broaden the scope of its fee-based operations. Whilst primary dealer income will continue to be the strongest component of profits in the short-term, it is our expectation that fee income will grow to be a meaningful contributor in the years ahead,” concluded Wirasekara.

First Capital Holdings PLC comprises of First Capital Treasuries Ltd., First Capital Asset Management Ltd., First Capital Equities Ltd., First Capital Markets Ltd. and First Capital Ltd. The company’s Board of Directors comprises of Executive Chairperson Manjula Mathews, Managing Director Dinesh Schaffter, Eardley Perera, Minette Perera, Nishan Fernando and Chandana de Silva as Independent Directors.