Monday Mar 09, 2026

Monday Mar 09, 2026

Monday, 24 April 2017 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The positive momentum which prevailed in the Treasury bond secondary market, with aggressive buying by local as well as foreign investors and further fuelled by an increase in market liquidity, came to a halt towards the end of the week, on the expectation of a Treasury bond auction in lieu of the coupon maturities coming up on 1 May.

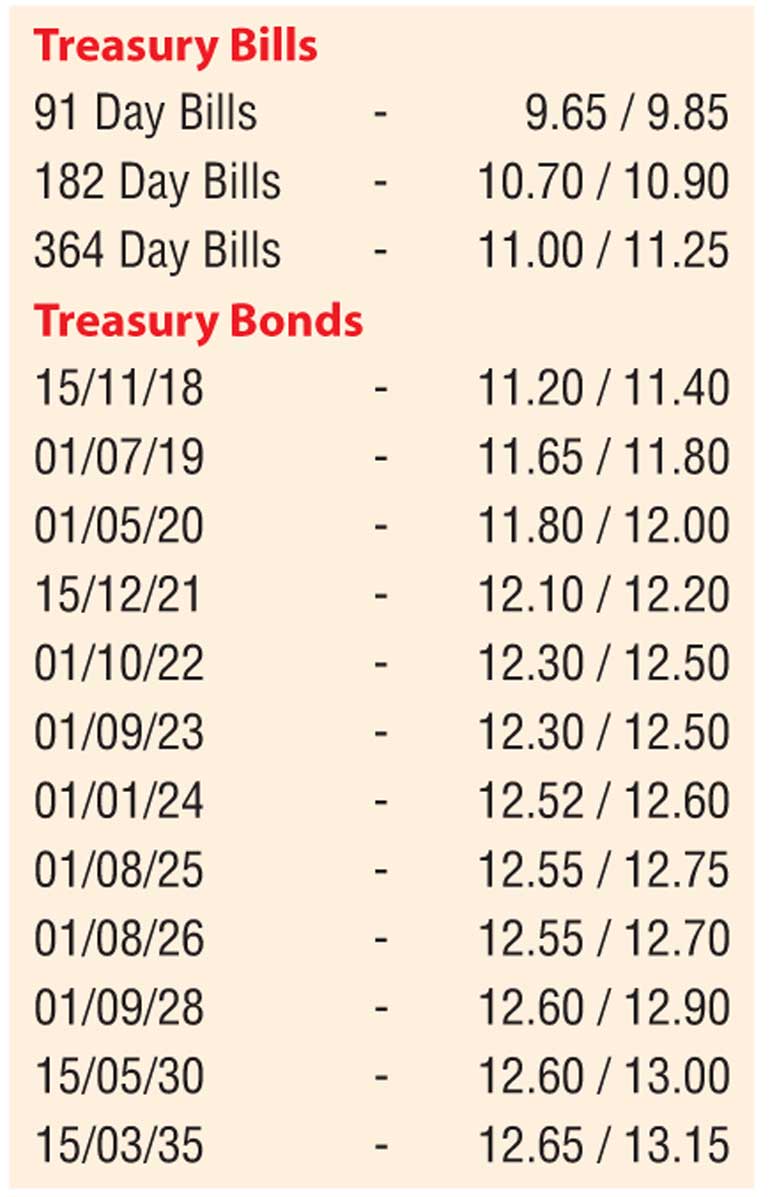

The yields of the liquid maturities of 15.12.21 and the two 2024 maturities (i.e. 01.01.24 and 01.08.24) dipped to weekly lows of 12.15%, 12.48% and 12.51% respectively in comparison to the opening highs of 12.25% and 12.70% each. Furthermore, the two 2019 maturities (i.e. 01.07.19 and 01.11.19) and 2021 maturities of 01.03.21, 01.05.21 and the 01.08.21 were seen declining to lows of 12.80%, 12.83%, 12.15%, 12.25% and 12.20% respectively. However, this trend came to a halt towards the end of the week with two-way quotes widening and increasing across most maturities.

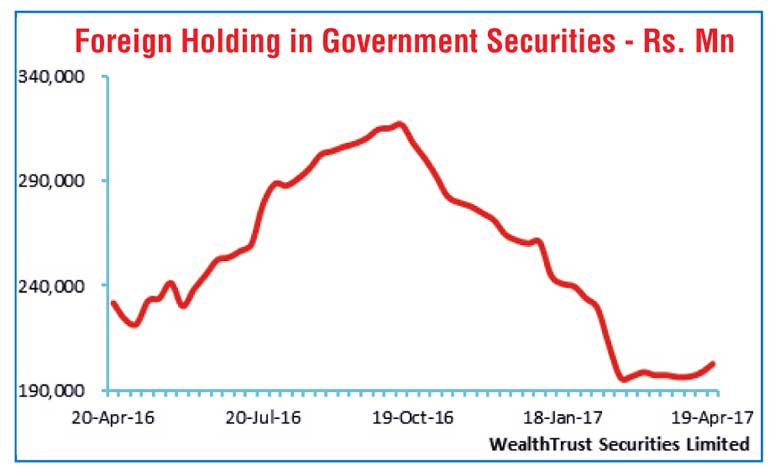

Meanwhile, the foreign holding in Rupee bonds continued to increase, recording its third consecutive week of inflows, with Rs. 4.1 billion coming during the week ending 19 April. The daily secondary market Treasury bond transacted volumes for the first four days of the week averaged Rs. 5.76 billion.

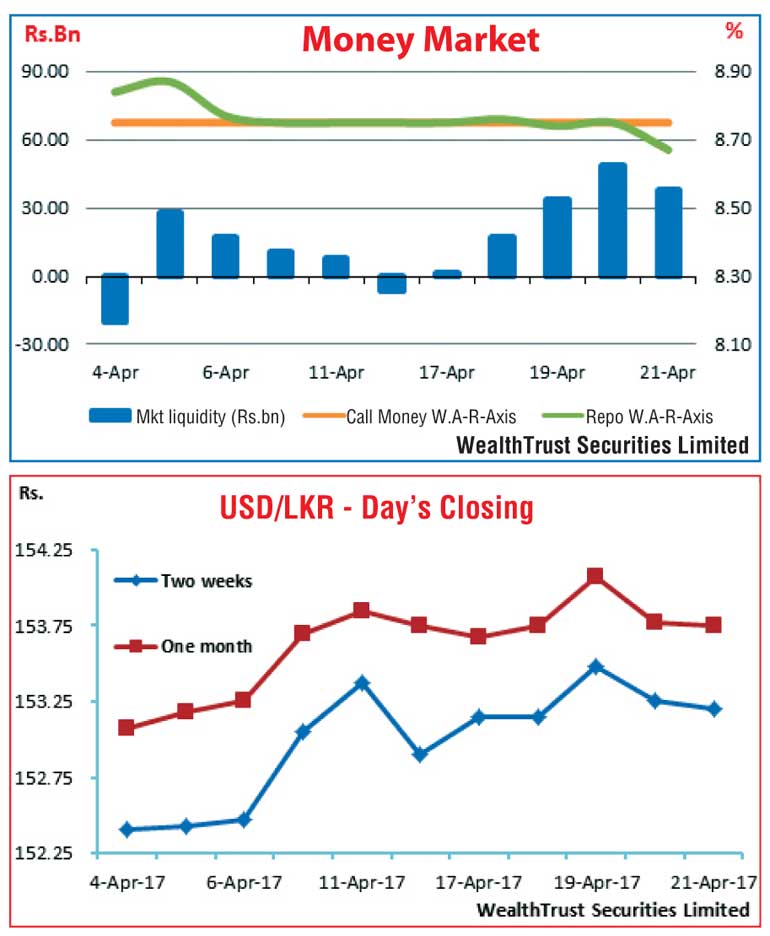

In money markets, overnight call money and repo rates averaged 8.75% and 8.73% during the week, with the net surplus liquidity in the system increasing to average at Rs. 27.64 billion, in comparison to the previous week’s average of Rs. 0.76 billion. The Open Market Operations (OMO) Department of the Central Bank of Sri Lanka was seen draining out liquidity during the week by way of overnight repo auctions at weighted averages of 7.35% to 7.52%.

Rupee dips during the week

The rupee on active two week forward contracts depreciated during the week to close at Rs. 153.15/25 against its previous week’s level of Rs. 152.80/00 on the back of importer demand.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 75.26 million.

Some of the forward dollar rates that prevailed in the market were one month – 153.70/80; three months – 156.10/30 and six months – 159.10/30.