Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 28 March 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

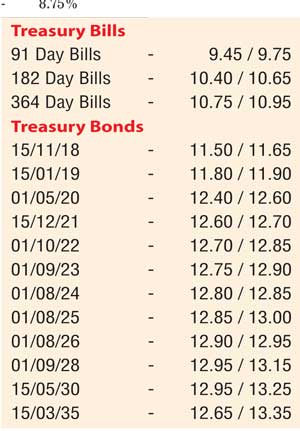

The downward trend in secondary bond market yields continued yesterday with the liquid maturities of 15.12.21, 01.08.24 and 01.08.26 hitting intraday lows of 12.65%, 12.80% and 12.88% respectively against its previous day’s closing levels of 12.80/90, 13.00/05 and 13.00/10 on the back of continued foreign and local buying interest.

In addition, the maturities of 01.06.18, 01.07.19, and 01.01.24 were traded at levels of 11.22% to 11.25%, 11.90% to 11.95% and 12.80% to 12.92% as well.

The total secondary market Treasury bond transacted volume for 24 March 2017 was Rs. 5.65 billion.

In money markets, overnight call money and repo rates remained mostly unchanged to average 8.75% and 8.80% respectively as the net surplus in the system increased to Rs. 14.19 billion yesterday. The OMO Department of the Central Bank of Sri Lanka was seen draining an amount of Rs. 13.00 billion at a weighted average of 7.75%, by way of an overnight repo auction.

Rupee dips marginally

The USD/LKR rate on the active two-week forward contracts dipped marginally yesterday to close the day at levels of Rs. 152.65/75 against its previous day’s closing level of Rs. 152.55/65 on the back of importer demand outweighing export conversions and bank selling interest.

The total USD/LKR traded volume for 24 March 2017 was $ 50.65 million.

Some of the forward USD/LKR rates that prevailed in the market were three months - 155.45/60 and six months - 158.20/40.

Correction

Given below are the correct policy rates applicable from 24 March 2017.

Standing Deposit Facility Rate (SDFR) - 7.25%

Standing Lending Facility Rate (SLFR) - 8.75%