Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 5 January 2016 00:05 - - {{hitsCtrl.values.hits}}

Activity in secondary bond markets dry up once again

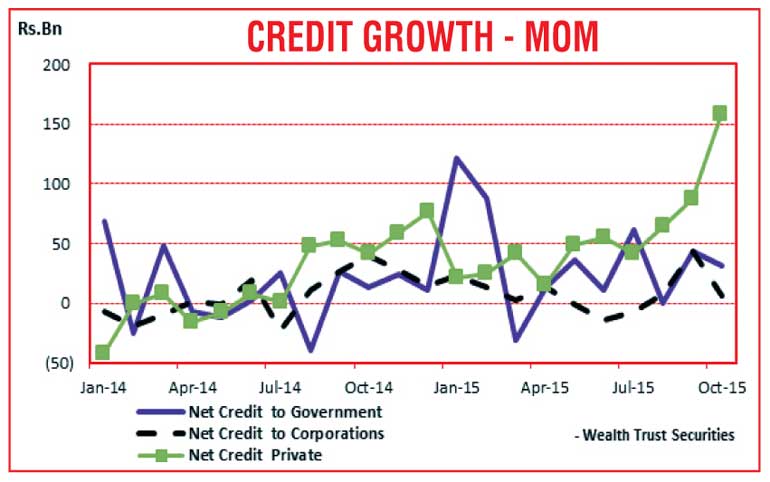

Net credit to the private sector, reflecting a year on year increase of 26.3%, soared to an all-time high of Rs.158.3 billion for the month of October. This is in comparison to the previous months all time high figure of Rs.87.6 billion. Furthermore, credit to the government and corporations too increased by Rs.31.8 billion and Rs.5.5 billion respectively with total credit increasing to Rs.195.6 billion in comparison to its previous month’s figure of Rs.173.2 billion.

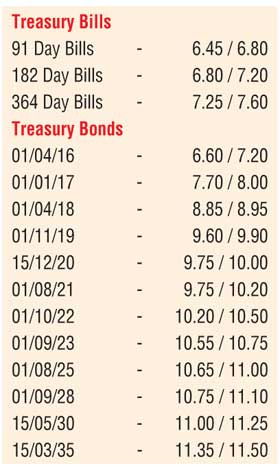

Activity in the secondary bond market dried up once again, with the two way quotes increasing and widening. The liquid 2018 maturities of 01.04.18 and 15.08.18, along with the 01.11.19, 01.09.23 and 15.03.35 were quoted at levels of 8.85/95, 8.90/00, 9.60/90, 10.55/75 and 11.35/50 respectively.

Given below are the closing, secondary market yields for the most frequently traded T – bills and bonds.

Meanwhile in money markets, overnight repo rates decreased marginally to average 6.30% as surplus liquidity stood at a high of Rs.112.26 billion, whilst the overnight call money rate remained mostly unchanged to average 6.44%.

The OMO department of the Central Bank was seen mopping up an amount of Rs.19.00 Billion via two term repo auctions at yields of 6.38% for 14 days and 6.43% for 21 days.

Rupee depreciates once gain

Meanwhile in Forex markets, the rupee lost ground marginally yesterday to close the day at levels of Rs.144.35/45 against the previous day’s closing levels of Rs.144.20/30.

The total USD/LKR traded volume for the 01st of January 2016 was US $ 2.25 million.

Given below are some forward USD/LKR rates that prevailed in the market,

1 Month - 145.00/30

3 Months - 146.30/60

6 Months - 148.00/30