Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 24 February 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Central Bank of Sri Lanka was seen increasing its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) by 50 basis points each to 6.50% and 8.00% respectively at its monthly monetary policy announcement for the month of February on Friday, the first such move since April 2012.

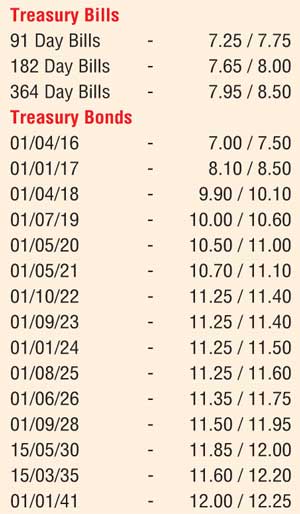

This in turn led to secondary market bond yields increasing in two way quotes as it widened as well. A limited amount of activity was witnessed on the 1 September 2023, 15 May 2030 and 1 January 2041 maturities within the range of 11.28% to 11.32%, 11.85% to 11.90% and 12.00% to 12.02% respectively.

This was ahead of today’s weekly Treasury bill primary auction will have on offer a total amount of Rs. 22 billion, consisting of Rs. 12.0 billion on the 182 day and Rs. 10.0 billion on the 364 day maturities. The 91 day maturity will not be on offer once again at the auction after a lapse of one week. At last week’s auction, the weighted average on the 91 day bill increased by 13 basis points to 7.14% while all bids on the 182 day and 364 day maturities were rejected.

Meanwhile in money markets, the overnight call money rate was seen hitting a two year high of 7.50% yesterday to average 7.49% following the increase in CBSL’s standing facility rates as surplus liquidity was seen increasing to Rs.36.97 billion. In addition, overnight guilt back securities were seen hitting a ten month high of 7.35% as well to average 7.18%. All bids received for the overnight Reverse Repo auction conducted by the Open Market Operations department (OMO) were rejected.

Rupee remains steady

The USD/LKR rate on the active one week forward contract was seen closing the day broadly unchanged at Rs.144.60/70 against its previous day’s closing levels of Rs.144.60/65. The total USD/LKR traded volume for 18 February was $ 44.13 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 145.20/30; three months – 146.45/55; and six months – 148.45/55.