Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 27 June 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Central Bank of Sri Lanka’s Treasury bill holding continued its declining trend dropping to over an eight month low of Rs.143.39 billion by 23 June 2017 following its peak of Rs.321.33 billion recorded on the 05 January 2017.

In the secondary bond market, the overall yield curve, witnessed a considerable parallel downward shift for a second consecutive week, backed by both local and foreign buying and the outcome of the weekly Treasury bill auction.

Foreign buying of rupee bonds, which has been prevalent over the past six weeks, continued with a further inflow of Rs.3.39 billion for the week ending 21st June, while the weighted average yields of the 182 day and 364 day maturities continued to decrease, with the total accepted amount at the auction just falling short of the total offered amount of Rs. 30.5 billion.

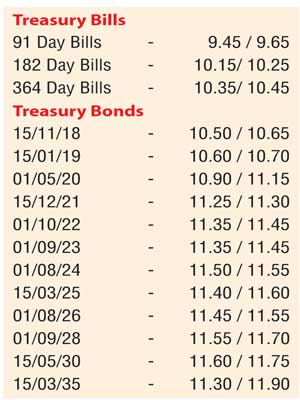

Buying interest of the 2021 (i.e. 01.08.21 and 15.12.21), 2023 (i.e. 15.05.23 and 01.09.23), 2024 (i.e. 01.01.24 and 01.08.24) and 01.08.26 maturities, resulted in their yields decreasing to weekly lows of 11.20% each, 11.35%, 11.37%, 11.40% each and 11.44% respectively when compared against the previous weeks closing levels of 11.35/40, 11.38/42, 11.42/50, 11.45/53, 11.47/55, 11.50/58 and 11.56/60. This led to heightened activity resulting in the parallel shift downwards of the yield curve. Furthermore, the shorter end maturities of 15.11.18 and 15.01.19 traded at lows of 10.55% and 10.60% respectively.

Meanwhile, the Central Bank announced at its policy meeting held on 23 June that policy rates would remain unchanged at 7.25% and 8.75%.

The daily secondary market Treasury bond transacted volume for the first four days of the week averaged Rs.5.37 billion.

In money markets, the overnight call money and repo rates remained mostly unchanged to average at 8.75% and 8.83% respectively, as the Open Market Operations (OMO) Department of the Central Bank continuously infused liquidity by way of overnight Reverse repo auctions at a weighted average of 8.75%. The net liquidity shortfall in the system stood at Rs.30.57 billion.

Rupee spot contracts become active

In the forex market, spot contracts became active once again, and closed the week at Rs.153.23/30 subsequent to trading within a range of Rs.153.05 to Rs.153.40.

The daily USD/LKR average traded volume for the four days of the week stood at US $ 73.32 million.

Some of the forward dollar rates that prevailed in the market were 1 Month - 154.15/25; 3 Months - 156.15/25 and 6 Months - 159.05/20.