Friday Mar 06, 2026

Friday Mar 06, 2026

Friday, 23 October 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The decreasing trend in secondary market bond yields witnessed over the previous two days came to halt yesterday as yields were seen increasing across the yield curve driven by the announcement of Treasury bond auctions to the tune of Rs. 30 billion.

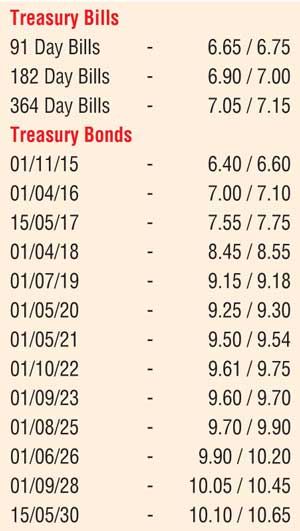

Selling interest on the two 2019 maturities (i.e. 1 July 2019 and 15 September 2019), the 1 May 2020, the two 2021s, the 1 October 2022, the 1 September 2023 and the 1 August 2025 saw its yields increase to daily highs of 9.20% each, 9.35%, 9.53%, 9.50%, 9.67%, 9.70% and 9.75 respectively as activity continued to remain high.

However, demand for 2018 maturities (i.e. 1 April 2018, 15 August 2018 and 15 November 2018) saw its yields dip to daily lows of 8.50%, 8.60% and 8.65% respectively while on the long end quotes widened. In secondary market bills, the 91 day bill was quoted at 6.65/75 while August 2016 bills were quoted at levels of 6.90/00.

Meanwhile in money markets, overnight repo rate decreased further to average 6.27% as surplus liquidity stood at Rs. 65.04 b yesterday. The Overnight call money rate averaged at 6.35%.

Rupee drops once again

The increasing importer demand leading into the season saw the rupee on spot contracts dip to a closing low of Rs. 141.05/15 against its previous day’s closing levels of Rs. 141.00/10. The total USD/LKR traded volume for 21 October was $ 51.60 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 141.65/70; three months – 142.75/90; and six months – 144.30/50.