Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 10 February 2016 00:35 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

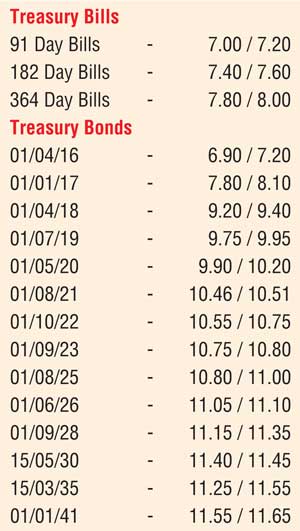

In the secondary bond market yesterday, yields were seen fluctuating as buying interest during morning hours of trading saw yields on the liquid maturities of 1 September 2023, 1 June 2026, 15 May 2030 and 1 January 2041 dip to intraday lows of 10.75%, 11.05%, 11.32% and 11.55% respectively.

However profit taking at these levels saw yields increase once again to highs of 10.78%, 11.07%, 11.40% and 11.60% as activity dried up towards the latter part of the day. In addition on the short end of the curve, 2018 maturities were seen changing hands within the range of 9.38% to 9.42%.

Today’s weekly Treasury bill auction will have a total amount of Rs.20 billion on offer consisting of only the 182 day and 364 day maturities as the 91 day will not be on offer once again. Rs.12 billion and Rs.8 billion will be on offer on the 182 day and 364 day maturities respectively. At last week’s auction, weighted averages increased across the board on all three maturities to 7.01%, 7.40% and 7.87%.

The overnight call money and repo rates remained broadly steady yesterday to average 6.69% and 6.40% respectively as surplus liquidity stood at Rs.45.19 billion.

One week forward contracts edge down marginally

The USD/LKR rate on one week forward contracts was seen edging down marginally yesterday to Rs.144.32/35 against its previous day’s closing of Rs.144.25/30 on the back of mild importer demand. However the spot rate remained stagnant for thirteenth consecutive day at Rs.143.95/20.

The total USD/LKR traded volume for 5 February was $ 55.95 million. Given are some forward USD/LKR rates that prevailed in the market: one month – 144.75/85; three months – 145.90/00; six months – 147.60/70.