Thursday Feb 26, 2026

Thursday Feb 26, 2026

Tuesday, 3 November 2015 00:15 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

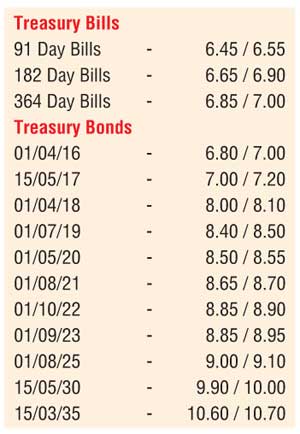

The yields for secondary market bonds continued to drop yesterday on continued buying interest driven by the increase in market surplus liquidity to a five month high of Rs 122.45 billion. Buying across the yield curve saw yields on the liquid maturities of the two 2019’s (i.e. 01.07.19 and 15.09.19), the 01.05.20, the two 2021’s (i.e. 01.05.21 and 01.08.21), the 01.10.22 and the 01.09.23 hit intraday lows of 8.45% each, 8.50%, 8.65% each, 8.88% and 8.90% respectively against its previous day’s closing levels of 8.70/80  each, 8.85/90, 8.95/05 each, 9.10/20 and 9.15/20. In addition, on the long end of the curve the 15.03.2035 maturity was seen changing hands within the range of 10.65% to 10.75% during the day.

each, 8.85/90, 8.95/05 each, 9.10/20 and 9.15/20. In addition, on the long end of the curve the 15.03.2035 maturity was seen changing hands within the range of 10.65% to 10.75% during the day.

In money markets, overnight call money and repo rates increased marginally to average 6.35% and 6.15% respectively despite surplus liquidity increasing to a five month high of Rs.122.45 billion yesterday. Liquidity is expected to further increase today following the realization of the US $ 1.5 billion sovereign dollar bond issue. The Rupee remains mostly unchanged. The USD/LKR rate on spot contracts remained mostly unchanged to close the day at Rs.141.00/05 yesterday as markets were at equilibrium. The total USD/LKR traded volume for 30 October was US $ 83.77 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 141.45/50; 3 Months - 142.40/60 and 6 Months - 143.85/10.

Rupee eases slightly in dull trade

Reuters: The Sri Lankan rupee edged down in thin trade on Monday as importer demand for the dollar surpassed greenback sales by exporters and banks, dealers said. |