Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 10 March 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Secondary bond market yields increased yesterday on the back of average volumes changing hands following the announcement of two further bond auctions due on 13 March 2017.

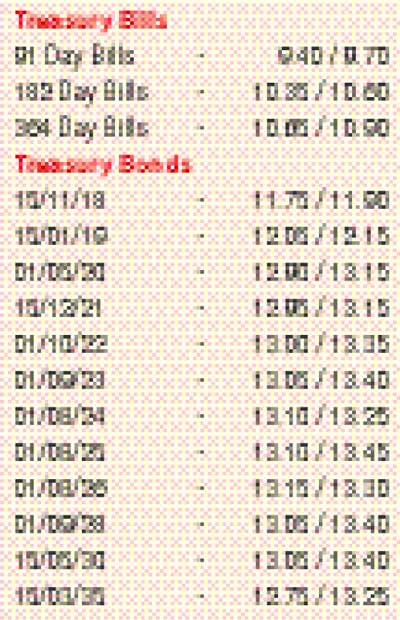

Activity centered on the short end to the belly end of the yield curve during morning hours of trading and tempered down towards the latter part of the week. Yields on the 01.05.2020, the two 2021s (i.e. 01.08.2021 and 15.12.2021), 01.08.2024 and 01.08.2026 were seen increasing to daily highs of 13.10%, 13.00%, 13.15% and 13.18% respectively on the back of selling interest.

The two bond auctions due on Monday 13 March will see a total amount of Rs. 20 billion on offer consisting of Rs. 12.50 billion on a 1.10 year maturity of 15.01.2019 and a further Rs. 7.50 billion on a 7.05 year maturity of 01.08.2024. The previously recorded weighted averages for these two maturities were 12.10% and 12.89% respectively.

In money markets, the overnight call money and repo rates remained mostly unchanged to average 8.50% and 8.57% respectively as the net deficit in the system dipped to Rs. 13.84 billion yesterday. The OMO Department of the Central Bank of Sri Lanka infused an amount of Rs. 13.00 billion at a weighted average of 8.50%, by way of an overnight reverse repo auction.

The USD/LKR rate on the active two weeks and one month forward contracts depreciated further yesterday to close the day at levels of Rs. 152.20/25 and Rs. 152.85/00 respectively against previous day’s closing levels of Rs. 152.00/15 and Rs. 152.50/70 on the back of continued seasonal importer demand.

The total USD/LKR traded volume for 8 March 2017 was $ 63.11 million.

Some of the forward USD/LKR rates that prevailed in the market were three months - 154.55/70 and six months - 157.35/50.