Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 25 April 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

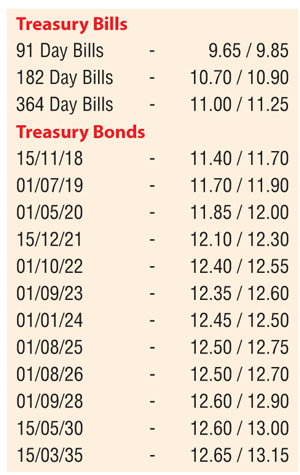

The secondary bond market remained active yesterday as yields were seen fluctuating as the liquid two 2024 maturities (i.e. 01.01.24 and 01.08.24) were seen hitting intraday lows of 12.40% and 12.45% respectively against its opening highs of 12.56% each.

Nevertheless, yields were seen increasing once again toward the latter part of the day to hit highs of 12.50% each once again on the back of fresh selling interest. Furthermore, activity was also witnessed of the 01.03.21, 01.10.22 and 01.08.26 maturities within the range of 12.05% to 12.12%, 12.44% to 12.45% and 12.49% to 12.60% respectively.

The total secondary market Treasury bond transacted volume for 21 April 2017 was at Rs. 3.4 billion.

In the money market, the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 47.00 billion on an overnight basis at a weighted average of 7.30% by way of an overnight repo auction as the net surplus liquidity in the system increased to Rs. 48.86 billion yesterday. The overnight call money and repo rates remained steady at an average of 8.75% and 8.61% respectively.

Rupee closes mostly unchanged

The USD/LKR rate on the two week forward contract was seen closing the day mostly unchanged at Rs. 153.10/20 subsequent to hitting an intraday low of Rs. 153.43.The total USD/LKR traded volume for 21 April 2017 was $ 84.01 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 153.45/55; three months -155.90/10 and six months - 158.85/00.