Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 6 March 2017 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The week ending 3 March 2017 saw a change in sentiment towards the positive, leading to the latter part of the week as fresh buying interest was seen in the secondary bond market with activity picking up considerably for the first time in three weeks.

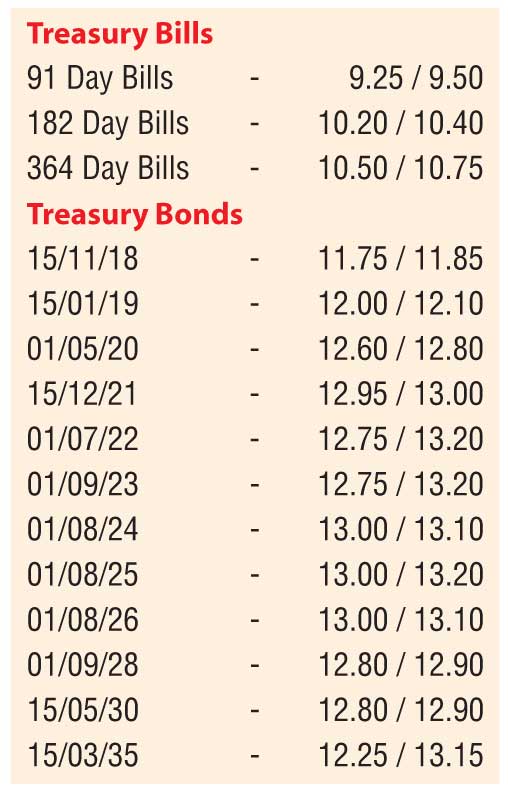

The yields on the 15.12.2021, 01.08.2024 and the 01.08.2026 were seen decreasing to weekly lows of 12.95%, 13.00% and 13.03% respectively against it weekly highs of 13.00%, 13.10% and 13.18% on the back of foreign and local buying interest.

In addition, on the long end of the curve, the two 2028’s (i.e. 01.05.28 and 01.09.28) and the 15.05.2030 maturities were seen changing hands within the range of 12.80% to 12.90% while on the short end 2018’s (i.e. 15.10.18 & 15.11.18) and 2019’s (15.01.19, 01.07.19, 15.09.19) changed hands within the range of 11.60% to 11.83% and 12.05% to 12.25% respectively.

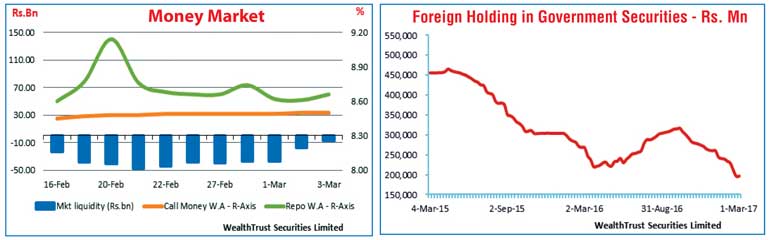

Meanwhile, the foreign holding in rupee bonds was seen increasing for the first time in eight weeks to record an inflow of Rs. 700 million for the week ending 1 March, reversing an outflow of Rs. 64.46 billion over the previous seven weeks.

In money markets, the overnight repo rate decreased during the week to average 8.66% against its previous week average of 8.81% as the average net liquidity shortfall decreased to Rs. 27.82 billion for the week against its previous week’s average of Rs. 42.62 billion. The OMO (Open Market Operation) Department of the Central Bank infused liquidity throughout the week on an overnight basis at weighted averages of 8.47% and 8.50% while the average overnight call money rate for the week stood at 8.49%.

Rupee remains volatile

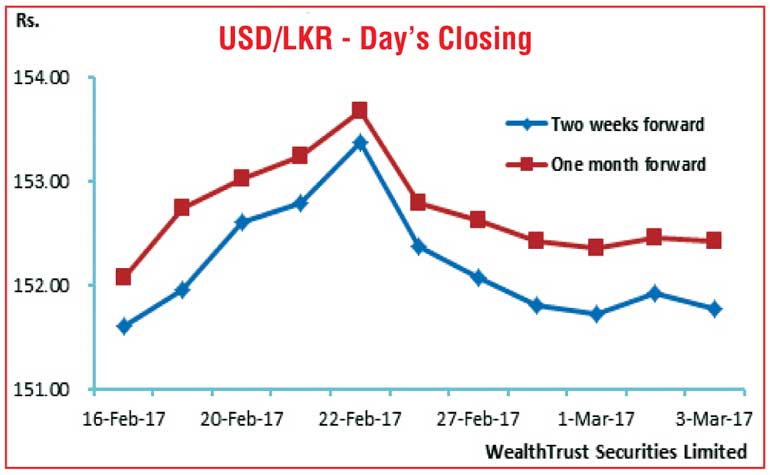

The USD/LKR rate on active two weeks and one month forward contracts appreciated during the beginning of the week to highs of Rs. 151.65/80 and Rs. 152.30/40 respectively against its previous week’s closing of Rs. 152.30/45 and Rs. 152.75/85 on the back of export conversion and foreign buying in rupee bonds.

However, it was seen losing some of its gains towards the later part of the week to close the week at levels of Rs. 151.70/85 and Rs. 152.35/50 respectively on the back of renewed importer demand.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 92.85 million.

Some of forward dollar rates that prevailed in the market were three months - 154.25/50 and six months - 157.15/30.