Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 4 April 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

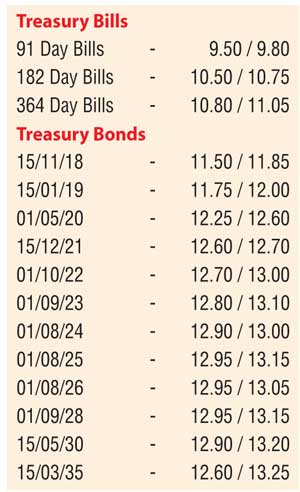

The secondary bond market was at a complete standstill yesterday, with most market participants opting to be on the sidelines ahead of today’s Treasury bond auction. The total amount on offer today will be Rs. 11.5 billion consisting of Rs. 4 billion each of the 15.12.2021 maturity and 01.01.2024 maturity and a further Rs.3.5 billion of the 01.08.2026 maturity.

The previous bond auction conducted prior to the policy rate hike of 25 basis points, recorded weighted averages of 12.30% and 13.14% respectively on the 15.01.2019 and 01.08.2024 maturities.

The total secondary market Treasury bond transacted volume for 31 March 2017 was Rs. 1.5 billion Meanwhile in money markets, the Central Bank of Sri Lanka infused an amount of Rs. 20.00 billion at a weighted average of 8.74% by way of an overnight reverse repo auction as the net liquidity shortfall in the system increased to Rs. 15.36 billion. This in turn saw the overnight call money and repo rates remaining mostly unchanged at 8.75% and 8.84% respectively.

Rupee appreciates further

The USD/LKR rate on active two-week forward contracts were seen appreciating further yesterday to close the day at levels of Rs. 152.30/45 against its previous day’s closing level of Rs. 152.40/55.

The total USD/LKR traded volume for 31 March 2017 was $ 38.00 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 152.95/00; three months - 155.00/20 and six months - 158.10/30.