Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 2 October 2015 00:06 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

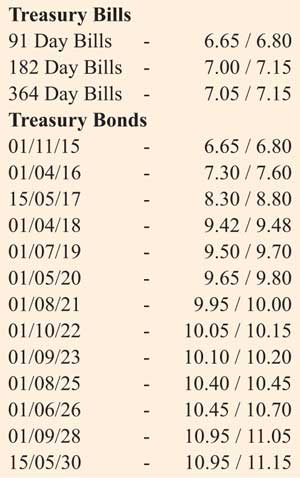

Activity in the secondary bond market picked up yesterday, as yields of the shorter tenure maturity of 1 April 2018 increased to hit intraday highs of 9.45%, with considerable volumes changing hands.

However, yields of the longer end maturity of 1 August 2025 declined with sizeable volumes changing hands within a range of 10.35% to 10.40% as against its previous day’s closing levels of 10.45/60.

Furthermore, the 1 September 2023 and 15 July 2017 maturities were traded within the range of 10.10% – 10.15% and 8.75% respectively.

Meanwhile in money markets, overnight call money and repo rates averaged 6.35% and 6.47% respectively as net surplus liquidity stood at Rs. 54.15 b.

Rupee remains mostly unchanged

In Forex markets, the USD/LKR rate remained mostly unchanged to trade within a narrow band of Rs. 141.20 to Rs. 141.30. The total USD/LKR traded volume for 30 September was $ 108.84 million.

Some forward USD/LKR rates that prevailed in the market were one month – 141.90/10; three months – 143.15/30 and six months – 144.65/80.