Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 23 November 2015 00:00 - - {{hitsCtrl.values.hits}}

The country’s banking and finance or the financial services industry is being identified as the biggest beneficiary of the unity Government’s maiden Budget presented on Friday.

The country’s banking and finance or the financial services industry is being identified as the biggest beneficiary of the unity Government’s maiden Budget presented on Friday.

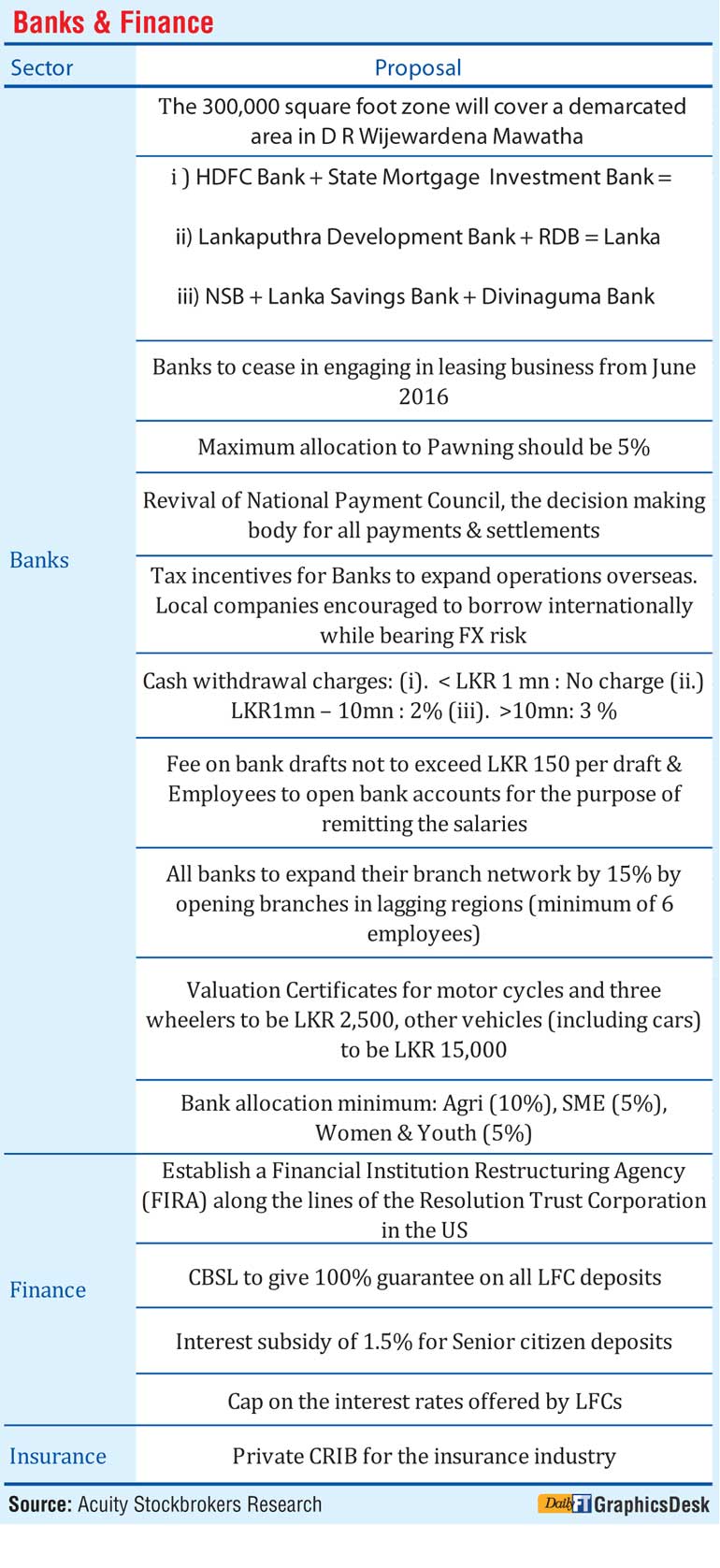

The flagship proposal is the setting up of the Colombo International Financial Centre (CIFC) at D.R. Wijewardena Mawatha. The choice of new location which the previous regime earmarked for Casino and Entertainment activities is despite Colombo city boasting several mini-financial services hubs such as at the World Trade Centre and Fort area as well as Navam Mawatha.

Successive Budgets in the past, as Finance Minister Ravi Karunanayake recalled, ‘have been waxing eloquent for many years of a financial centre in Sri Lanka to no avail’.

There had been multiple industry recommendations as well on the merits of Colombo being ideally positioned to be a financial hub.

However it is the current Government which has made some concrete moves via 2016 Budget though most analysts admit that several policy as well as other measures are needed to make the financial hub concept a reality. Now that Budget 2016 is explicit in terms of policy direction and the CIFC idea being inspired the successful Dubai International Financial Centre (see box story), which is a specialised zone itself, experts have emphasised an industry think tank along with relevant officials must be formed with clear timelines on the way forward.

Minister Karunanayake said Sri Lanka’s geographical location in the SAARC region which is home to almost one fourth of the world population certainly provides the country with the scope and scale such ventures require.

He said financial centres have the capacity to provide the impetus to enhanced growth in economies. “Such endeavours certainly require an investment on our part, which include special physical and digital infrastructure, human capital, regulatory and the legal infrastructure. This government believes in investing funds where feasible,” emphasised the Finance Minister.

The 2016 Budget stated that a specific zone will be built on the lines of the Dubai International Financial Centre and such other off-shore centres around the world. The zone will cover a demarcated area in D.R. Wijewardena Mawatha, where a 300,000 square feet facility will be constructed.

The proposed financial centre will have an own commercial court for resolution of commercial disputes in a quick and equitable manner keeping in line with the financial centre regulatory requirements.

“We expect that this initiative will convert the infamous casino proposal of the former government into a robust venture of a financial centre which will be creating a number of new employment opportunities,” a candid Finance Minister Karunanayake said during his Budget speech.

He invited domestic and international banks to operate in Sri Lanka and be part of the proposed centre and added that this operation will be ready to commence by 1 April 2016.

The far reaching overhaul of the Foreign Exchange regime also announced in 2016 Budget will give credence to the new Government’s vision on CIFC.

Voluntary mergers in banking

The 2016 Budget also addressed the issue of financial services industry consolidation. Sri Lanka has been in the need for bigger banks. For better or worse, the finance companies saw regulator-directed mergers and acquisitions in the past year. Following a review of the process by the new Government, any future mergers within the industry was to be made voluntary.

The Finance Minister said Sri Lanka has 32 banks registered with the Central Bank of Sri Lanka and given that the banking sector comprises a few large systemically important banks and a few smaller banks, ‘We encourage the voluntary mergers of banks that will result in stronger balance sheets, which in turn will enable better ratings and wider access to markets both domestic and foreign’.

He reiterated that such mergers should be carried out while ensuring the job security of all related staff.

Though encouraging voluntary mergers, the Government has removed a relief previously provided for such industry moves. Finance Minister said the qualifying payment relief introduced on the expenditure associated with cost of acquisition or merger of banks or financial companies under the Banking and Financial institutions consolidation process will be removed considering the deduction already available as a cost.

A further tax move was corporate tax on banking and finance (as well insurance and leasing) was increased to 30% from 28%.

Select state banks first off the block

The Government via the Budget showed it was leading from the front on essential restructuring and consolidation within the state sector.

The Finance Minister proposed to merge the HDFC Bank and State Mortgage and Investment Bank (SMIB) to create a much stronger and larger ‘National Housing Bank’. Additionally, Lankaputhra Development Bank (LDB) is to be merged with Regional Development Bank (RDB) to create the ‘Lanka Enterprise Development Bank’.

Furthermore, Sri Lanka Savings Bank (the successor to the failed Pramuka Bank) is to be merged with National Savings Bank. The Divineguma Bank which has a deposit portfolio of around Rs. 59 billion will be merged with NSB as well as the former lacks the capacity to manage a fund of this magnitude. “It is incumbent upon us to protect this fund given that the stakeholders are some of the most vulnerable in our society,” said Karunanayake in recommending the merger Divinaguma Bank to the National Savings Bank for the protection of the fund ensuring professional management.

Commercial banks told ‘Stick to your core’

Though no longer having any oversight role on Central Bank or state banks and banking sector directly, the 2016 Budget saw Finance Minister exercising some authority. This was when he proposed that licensed banks should concentrate on their core banking activities rather than going after the more active leasing business, especially auto loans.

“The leasing business has become a distraction to core banking functions and as such Banks should cease in engaging in leasing business from 1 June 2016,” was the emphatic directive from the Finance Minister.

He also took a further dig at commercial banks. “Today banks are not keen to lend to certain important sectors of the economy, which has hampered the growth of these sectors. In this background, I propose that all the banks should lend at least 10% of their loan portfolio to Agriculture, 5% to SME and 5% to Women and Youth,” Minister Karunanayake stipulated.

Given the Government’s belief that these directed sectors weren’t receiving enough support from the banking sector one cannot find fault with Finance Minister’s stance. His directive is also interesting as it comes amidst Central Bank’s stance it wouldn’t ‘direct’ banks where to lend. This practice in the past was often termed political. This time around, Finance Minister has taken that role.

Commercial banks were also told limit their pawning business. Reason was the impact the international gold prices have had on the local banks especially with large pawning portfolios. “I urge the banking sector to limit their pawning business to a maximum of 5% of their loan portfolios,” said Minister Karunanayake.

Greater financing for SMEs

Support for SMEs was a further directive. Though he acknowledged and commended the banking sector for its efforts so far in terms of extending reach, more was desired. He said that the established financial institutions including banks have shown a marked reluctance to lend to innovative Micro Small and Medium Enterprises (MSMEs) due to high administration costs and high risks involved in these sectors.

Financial Institutions have become over reliant on collateral based financing which new entrepreneurs as well as existing entrepreneurs are not in a position to provide. Therefore, the 2016 Budget has proposed to implement a MSMEs Credit Guarantee Scheme in 2016 with Rs. 500 million contributed by the government as initial capital together with the assistance of selected financial institutions.

Under this scheme the 75% of the principal amount if in default of the total facility will be guaranteed. This will expand MSME’s access to financing options which are relatively cheaper and longer termed. In this regard, we have also been successful in obtaining a credit line of USD 100 million from the

ADB is to support MSME lending at concessional rates. Further, the funding schemes such as Saubhagya scheme and the Poverty Alleviation Micro-finance Project (PAMP) that Central Bank has implemented to help SMEs will be merged into one large SME facility. The merger of these funds will create synergies that will enable the Central Bank to serve the MSME sector better, Finance Minister said.

More rural bank branches in the offing

“The Sri Lankan Banking sector penetration has increased significantly with the Banks themselves most often expanding horizontally. Our banks today offer ATMs, e-banking facilities, and other innovative facilities that have extended banking to the door step of the customer. While I congratulate the banking sector for their expansions, I also note that our banks have confined themselves to collateral based lending and have shown a marked reluctance to engage in ‘business model’ based lending.

This approach has become an impediment to the development of the SME sector and the business startup culture in Sri Lanka,” stressed the Finance Minister.

However, the Government also believes rural areas need more banking. Finance Minster said there’s over banking in urban areas and under banking in regions creating an imbalance in the accessibility to finance.

To address this imbalance, while enhancing economic activities, it was proposed to require all banks to expand their branch network by 15% by opening branches in lagging regions. Each of these branches will have to employ at least 6 employees, he added.

In 2014, the number of new banking outlets (including student savings units) opened

totalled to 67 and there were 91 automated teller machines (ATMs) installed in 2014. The banking sector penetrated outside the Western Province with 43 new banking outlets and 43 ATMs being established in the regions. Accordingly, by end 2014, the banking system was operating with 6,554 banking outlets and 2,635 ATMs.

Sri Lanka’s banking density (No. of bank branches per 100,000 persons) had increased to 27.0 in 2013 from 18.8 in 2005.

Banks were also urged to lend to customers who are engaging in stock market activities.

Go global

The Budget 2016 is also encouraging local banks to go global. At present, only two banks have established presence overseas according to the Finance Minister. “But the opportunities are numerous. I am also confident that our local banks have the capacity to tap such opportunities. As such, I propose to encourage the banks to expand their operations overseas, by making use of the existing tax incentives for such expansions,” said Minister Karunanayake.

Commercial banks were also urged to expand their off-shore activities and deposit such foreign exchange with the Central Bank. This way, the process will not only strengthen the gross official reserves but will also avail the banks to have additional local currency for their business operations.

At the same time, he also urged local companies are encouraged to borrow internationally for their business expansion activities based on their balance sheets. The borrowing company should bear the exchange risk, while the borrowing rate of interest should be broadly consistent with the prevailing competitive market rates. Repatriation of monies as interest payments, will be monitored by the Central Bank to avoid any malpractices, the Minister added.

Promoting cash-less society!

In the 2016 Budget the Government expressed keenness to create a cash-less society encouraging people to embrace the digital or electronic route. “We are moving into a sophisticated cash management system,” said the Finance Minister. To discourage cash transportation in line with security considerations, the 2016 Budget proposed following charges on cash withdrawals.

i. Less than 1 million: No charge

ii. Between 1 million and 10 million: 2%

iii. Above 10 million: 3%

Following the 2016 Budget presentation, at the KPMG post-Budget Forum, the Finance Minister clarified that this move wasn’t a major revenue proposal but more to deter growing number of cash payments informally outside the normal banking channels thereby evading taxation as well as illegally with the latter encouraging corruption. High incidents of informal payments within the construction industry were cited.

To facilitate more formal banking based transactions, the Budget 2016 has proposed the reduction of fee charged on bank drafts to Rs. 150 or lower per draft. At present the charge is around Rs. 250 per bank draft.

The Government also urged all employers to instruct their employees to open bank accounts for the purpose of remitting the salaries.

Furthermore to keep a better track of all statutory payments, Finance Minister has also proposed each company to maintain a dedicated bank account for direct debit purposes.

To channel direct welfare payments to the Samurdhi beneficiaries, the Government has also proposed to effect all such payments through the banking system which has significant branch outreach in the country. “This method which is fairly transparent will allow a seamless transfer of benefits without interference, leakages and corruption,” said Minister Karunanayake.

National Payment Council

The 2016 Budget also outlined plans to revive plans for the setting up a National Payment Council which is the decision making body for all payments and settlements in the country. This is as part of the government strategy to improve and enhance the development of the financial systems of the country. This will also facilitate the establishment of a financial centre in Colombo.

Dud-cheques a criminal offence

Despite existing regulations, the Government further strengthened measures to curb the issuance of cheques without corresponding funds in accounts.

“Issuing cheques without sufficient funds in bank accounts and returning of cheques has become a serious issue in the banking system which is also a fraudulent way of carrying out business,” the Finance Minister told Parliament on Friday.

In order to inculcate a credible business culture and to safeguard the customers, he proposed via 2016 Budget to consider the situations where cheques are retuned as a criminal offence and enforce stringent legal action against such offences.

Extending a previous Budget proposal, Finance Minister also proposed that the monies lying in dormant accounts of commercial banks to be remitted to the Consolidated Fund, by 1 January, 2016.

Creating a savings culture

The Budget 2016 also requested commercial banks to open account for all school children to inculcate savings habit.

“Given the importance of enhancing the national savings of the country, the creation of a savings culture has become important. In this background, I request all banks to open a child savings account for every child attending school by depositing a minimum of Rs. 250 per child per year,” Karunanayake said.

He also said the Bankers’ Association has kindly come forward to support the government’s policy. “I encourage the Banking community for the initiatives and support provided to this laudable act. This will commence from 1 January 2016,” the Finance Minister added during the 2016 Budget presentation.

About Dubai International Financial Centre

The Dubai International Financial Centre (DIFC) is the financial hub for the Middle East, Africa and South Asia, providing a world-class platform connecting the region’s markets with the economies of Europe, Asia and the Americas. It also facilitates the growth in South-South trade and investment. An onshore, international financial centre, DIFC provides a stable, mature and secure base for financial institutions to develop their wholesale businesses.

The Centre offers all the elements found in the world’s most successful financial industry ecosystems, including an independent regulator, an independent judicial system with a common-law framework, a global financial exchange, inspiring architecture, powerful, enabling support services and a vibrant business community. The infrastructure within the district features ultra-modern office space, retail outlets, cafes and restaurants, art galleries, residential apartments, public green areas and hotels.

Located midway between the global financial centres of New York, London in the West and

Singapore, Hong Kong in the East, DIFC (GMT +4) fills a vital time-zone gap with a workday that bridges the market and business hours of financial centres in both Asia and North America.

Currently, more than 1,327 active registered companies operate from the Centre, including 21 of the world’s top 25 banks, 11 of the world’s top 20 money managers, 7 of the top 10 insurance companies, and 9 of the top 10 law firms. The Centre supports a combined workforce of 18,521 people.

DIFC continues to pursue expansion into new services and sectors within the Middle East, Africa and South Asia region, an area comprising over 72 countries with an approximate population of 3.0 billion and nominal GDP of $ 7.9 trillion.

Benefits in setting up in DIFC

Platform to access regional wealth and investment opportunities

100% foreign ownership

Zero% tax rate on income and profits (guaranteed for a period of 50 years)

A wide network of double taxation treaties available to UAE incorporated entities

No exchange controls (free capital convertibility)

High standards of laws, rules and regulations

International legal system based on Common Law of England and Wales

A wholly transparent operating environment, complying with global best practices, and internationally accepted laws and regulatory processes

A variety of legal vehicles that can be established with capital structuring flexibility

Access to a large pool of skilled professionals residing in Dubai and the region

A modern transport, communications and internet infrastructure

A responsive one-stop shop service for visas, work permits and other related requirements

An independent common law judicial system

City within a city

DIFC has been designed as a ‘city within a city’ that provides a complete range of business and lifestyle facilities for today’s professionals.

The infrastructure within the financial district features:

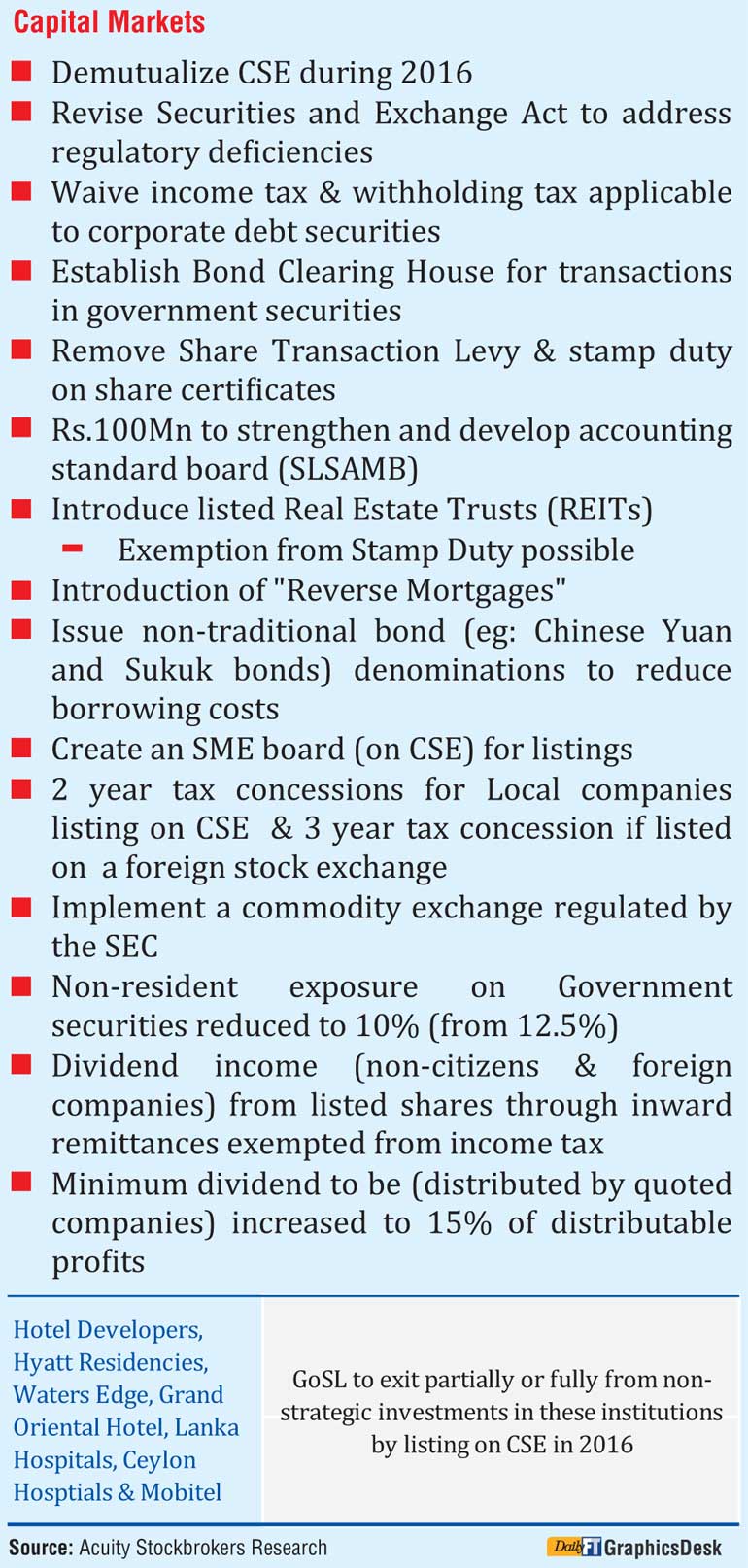

Colombo Stock Exchange (CSE) Chairman Vajira Kulatilaka is elated with the 2016 Budget for a host of measures aimed at boosting the capital market.

“This Budget not only helps to activate the capital market but also supported a vision to achieve greater heights,” said the CSE chief in a statement which commended the range of proposals concerning the capital market.

Following is the full text.

It is admirable to note the support extended to the capital market of Sri Lanka through the 2016 Budget.

Firstly, it has maintained all the concessions granted to the capital market by previous Governments.

Secondly, it is a forward-looking budget. It encourages the introduction of REITs, an extremely positive step to introduce an alternative investment option i.e. real estate to investors. REITs will enable smaller investors to benefit from returns generated from real estate by investing a small amount of money.

Encouragement given to list dollar denominated securities of foreign companies will help the Sri Lankan capital market achieve hub status in the region. The waiving of the requirement to set up SIA accounts to foreign investors is also a positive step to minimise administrative burdens for global investors.

The budget has requested to expedite to the demutualisation process of the stock exchange. This will enhance the governance aspects of the capital market. The CSE and SEC will work towards achieving the target of completing this process during 2016.

It also encourages setting up Venture Capital and Private Equity Funds, an essential prerequisite for funding business from ideas of entrepreneurs to the growth of such businesses. These firms will act as feeders to the capital market to raise capital or divestitures. It should be highlighted that whereever Venture Capital and Private Equity thrived, the business enterprises developed and the countries achieved growth.

An example is South Korea. Most of the leading technology companies such as Google and Facebook and Indian IT companies are funded by Venture Capital and Private Equity Capital.

The budget has suggested setting up a SME board at the Colombo Stock Exchange. We will introduce this shortly. The idea is to offer a listing option for SMEs with less stringent conditions to raise capital.

The idea of divestures of non-core businesses of the Government and the listing of Government-owned entities is extremely helpful to capital market growth and to increase market capitalisation.

The removal of the Share Transaction Levy will stimulate trading in the share market, thus increasing the liquidity. This will help to address one of the major drawbacks of the Sri Lankan share market.

The Budget has supported minority shareholders by increasing the minimum amount of dividend to be distributed by quoted companies.

I should say that this Budget not only helps to activate the capital market but also supports a vision to achieve greater heights.