Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 6 October 2016 00:25 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

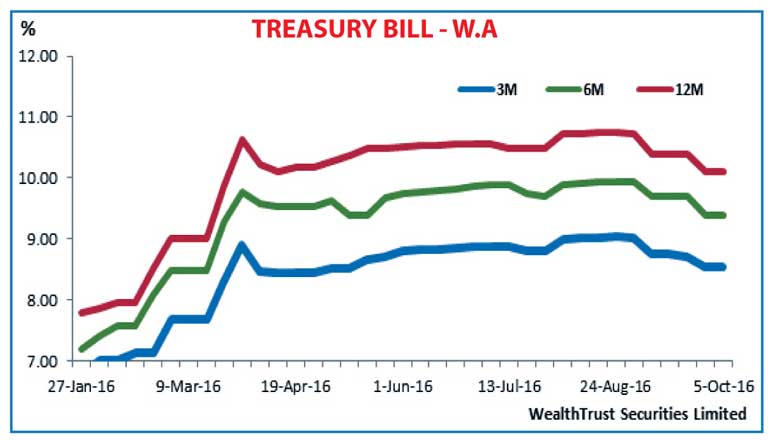

The weekly weighted averages were seen holding steady at its auction held yesterday following the previous weeks’ steep decline. The total accepted amount was seen falling short of the total offered amount of Rs. 26 billion by Rs. 7.2 billion. The total bids received to offer ratio was seen dipping to a four week low of 2.06:1.

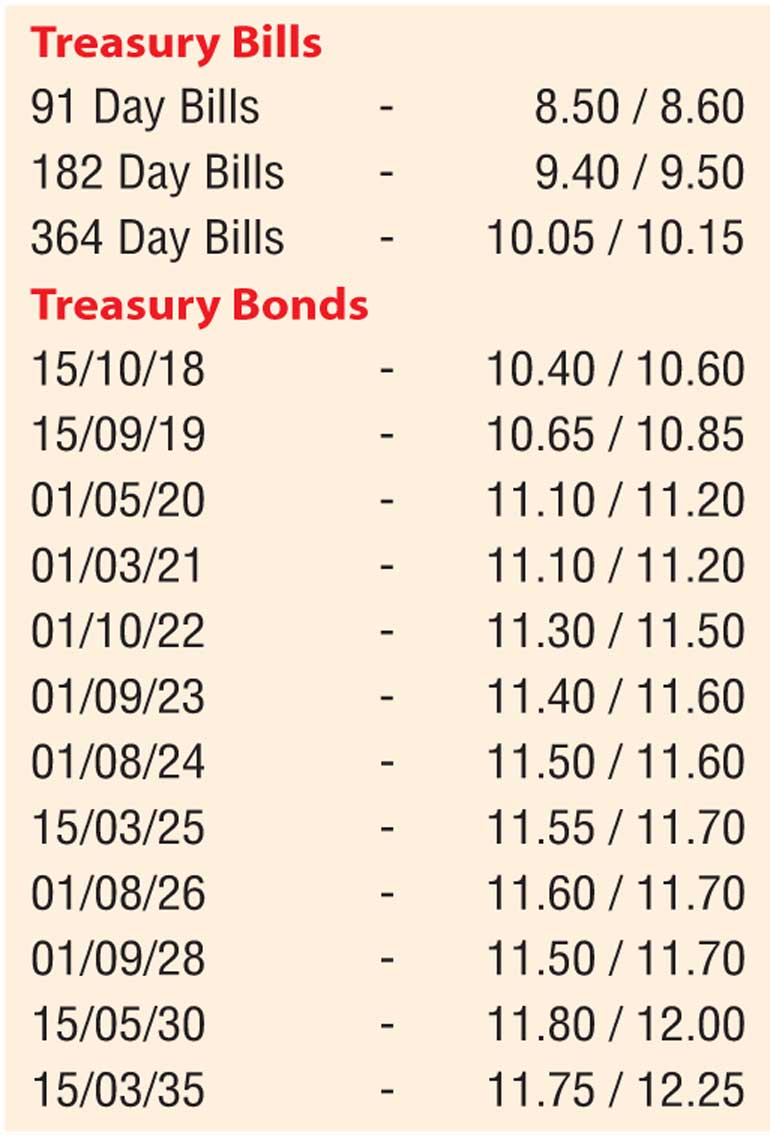

The activities in secondary bond markets moderated yesterday as yields were seen increasing for a fourth consecutive day. The liquid maturities of 01.03.21, 01.08.24 and 01.08.26 were seen increasing to daily highs of 11.15%, 11.55% and 11.65% respectively against its days opening lows of 11.10%, 11.45% and 11.55%. In addition, two way quotes on the rest of the yield curve were seen increasing as well.

In money markets, despite the net liquidity shortfall dipping to Rs. 48.31 billion yesterday, the average on overnight Repo was seen increasing to 9.01% against its previous day’s average of 8.74% while call money remained steady at 8.42%. The OMO department of Central Bank injected an amount of Rs. 54 billion on an overnight basis at a weighted average of 8.49%.

Rupee dips marginally

Meanwhile in Forex markets, the spot rate was seen dipping marginally to close the day at Rs. 146.75/80 against its previous day’s closing of Rs. 146.69/75. The total USD/LKR traded volume for the 04th of October 2016 was $ 56.05 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 147.60/70; 3 Months - 149.30/40 and 6 Months - 151.75/85.

Secondary market bond yields increase for a fourth consecutive day