Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 1 March 2016 00:01 - - {{hitsCtrl.values.hits}}

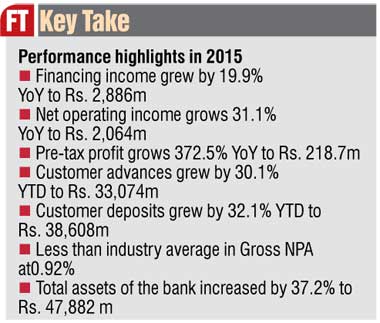

Amãna Bank recorded its first year of core business profitsin 2015 sustaining its trend in profitability which commenced in Q4 2014. According to the financials published, the bank recorded Rs. 218.7million as Profit Before Tax for the year ended 2015 which marks a remarkable turnaround when compared to the pre-tax loss of Rs. 80.2 million posted in 2014 constituting a growth of 372.5%.

The bank’s top line recorded commendable growth with financing income reaching Rs. 2.9 billion in 2015 whilst increasing its net  financing income by 22.4% to Rs. 1.5 billionfor the same period. Net operating income surpassed Rs. 2billion for the year ended 31 December 2015, reflecting a healthy growth of 31.1%. Through various initiatives for cost containment the total operating expenses incurred were contained to a YoY increase of 7.5% to record Rs. 1.7 billion. The bank’s growing popularity and acceptance resulted in a 32.1% growth in customer deposits during the year to reach Rs. 38.6 billion and a 30.1% growth in customer advances to reach Rs. 33.1billion.Such growth enabled the bank to grow the total assets by a significant 37.2% after it closed at Rs. 47.9 billion.

financing income by 22.4% to Rs. 1.5 billionfor the same period. Net operating income surpassed Rs. 2billion for the year ended 31 December 2015, reflecting a healthy growth of 31.1%. Through various initiatives for cost containment the total operating expenses incurred were contained to a YoY increase of 7.5% to record Rs. 1.7 billion. The bank’s growing popularity and acceptance resulted in a 32.1% growth in customer deposits during the year to reach Rs. 38.6 billion and a 30.1% growth in customer advances to reach Rs. 33.1billion.Such growth enabled the bank to grow the total assets by a significant 37.2% after it closed at Rs. 47.9 billion.

Another key highlight during 2015 was the Non Performing Advances (NPA) ratio which through continuous follow up was contained right throughout the year to ensure that the asset quality was not compromised. As such, the Gross NPA ratio recorded at the close of 2015 was 0.92% which continues to be one of the lowest in the banking and finance industry.

Commenting on the journey of Amãna Bank thus far, Founder Chairman Osman Kassim said: “The establishment of Sri Lanka’s first Islamic Bank was once only a vision and a dream. So I am indeed delighted today to witness the success and the realisation of this vision. I am thankful for the dedication and perseverance of the staff, Management Committee, CEO and the Board of Directors towards enabling this achievement. The growth and profitability Amãna Bank has achieved within a short period will indeed honour and strengthen the confidence placed on us by the government, the regulator and shareholders. We have just crossed the first milestone in our journey. I am confident and eager about the future, where Amãna Bank rises to its full potential in its contribution to the country’s economy while believing in ‘superior customer service’ as its mantra to succeed.”

Commenting on the bank’s performance to date, Chief Executive Officer Mohamed Azmeer stated: “It gives me immense pleasure to have been a part of the bank’s turnaround from loss to profit. Being a new bank, achieving a pre-tax profit of Rs. 218 million was not an easy feat considering the market conditions that prevailed and the numerous challenges we had to face. Yet we were able to  succeed thanks to our customers and the team’s dedicated execution of the bank’s Strategic Plan. The key areas of focus which enabled this achievement were business alignment, customer service and processes improvement, cost containment and optimization of resources while managing the overall risk. While the future comes with its own set of challenges, I am confident of our ability to sustain this growth momentum in 2016 and ahead.”

succeed thanks to our customers and the team’s dedicated execution of the bank’s Strategic Plan. The key areas of focus which enabled this achievement were business alignment, customer service and processes improvement, cost containment and optimization of resources while managing the overall risk. While the future comes with its own set of challenges, I am confident of our ability to sustain this growth momentum in 2016 and ahead.”

Amãna Bank is the first Licensed Commercial Bank in Sri Lanka to operate in complete harmony with the non-interest based Islamic banking model and is listed on the Diri Savi Board of the Colombo Stock Exchange. Fitch Ratings, in October 2015, affirmed the Bank’s National Long Term Rating of BB(lka) with a Stable Outlook.

The bank was recognized as the Best ‘Up-and-Comer’ Islamic Bank of the World by ‘Global Finance Magazine’ at the 18th Annual World’s Best Banks Award Ceremony 2014 held in Washington DC, USA. Powered by the stability and support of its strategic shareholders including, Bank Islam Malaysia Berhad, AB Bank in Bangladesh and The Islamic Development Bank based in Saudi Arabia, Amãna Bank is making strong inroads within the Sri Lankan banking industry and is focused on capitalizing the growing market potential for its unique banking model across the country.