Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 28 January 2016 00:02 - - {{hitsCtrl.values.hits}}

Volatility witnessed on the short end of the yield curve

By Wealth Trust Securities

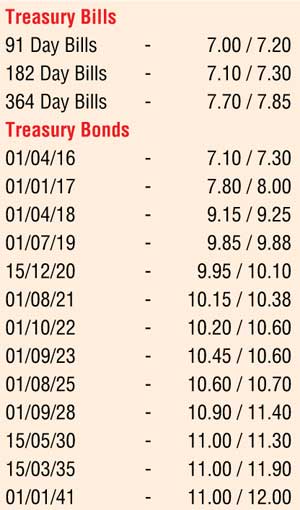

All bids received for yesterday’s weekly Treasury bill auction for the durations of 91 days, 182 days and 364 days were rejected for the first time in twenty weeks. The demand for high yields by investors was seen as the reason behind this move according to market sources. This in turn led to moderate volatility in secondary market yields on the short end of the yield curve, as the  increasing trend in morning hours of trading was seen reversing following the outcome of the Treasury bill auction.

increasing trend in morning hours of trading was seen reversing following the outcome of the Treasury bill auction.

Selling interest in morning hours of trading by foreign and local market participants saw yields on the liquid maturities of 01.07.2019, 15.09.2019, 01.05.2020 and 01.08.2021 increase to daily highs of 10.00%, 10.05%, 10.26% and 10.50% respectively on the back of considerable volumes changing hands. However, buying interest following the auction outcome saw yields dip to daily lows of 9.85%, 9.90%, 10.07% and 10.30% respectively on these maturities. In addition, a limited amount of activity was witnessed on the 15.07.2017, 01.04.2018, 15.08.2018 and 15.11.2018 maturities within the range of 8.35% to 8.50%, 9.20% to 9.30%, 9.45% to 9.55% and 9.50% to 9.60% respectively as well. This was ahead of today’s Treasury bond auctions where a total amount of Rs.15 billion will be on offer consisting of Rs.2 billion on a 04.10 year maturity of 15.12.2020, Rs.3 billion on a 10.04 year maturity of 01.06.2026 and Rs.5 billion each on a 14.03 year maturity of 15.05.2030 and a 29.01 year maturity of 01.03.2045. The said maturities recorded weighted averages of 9.79%, 9.35%, 11.46% and 11.73% respectively at their previous successful auctions held 23 December 2015, 27 November 2015, 8 January 2016 and 27 February 2015.

Meanwhile in money markets, the overnight repo rate continued to decrease to average at 6.51% as surplus liquidity in the system increased to Rs.62.11 billion. However, the attempt to drain out surplus liquidity on a term basis by the OMO department of Central Bank through term repo auction was not successful as only an amount of Rs.0.2 billion was accepted in successful bids at weighted averages of 6.50% for 11 days and 6.55% for 15 days against its total offered amount of Rs.20 billion. The overnight call money rate averaged at 6.80%.

Rupee remains stable

The USD/LKR rate on spot contracts remained steady closed the day Rs.143.95/10 yesterday. The total USD/LKR traded volume for the 26th of January 2016 was US $ 39.00 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 144.60/75; 3 Months - 145.75/95 and 6 Months - 147.65/85.

Stock market remains lacklustre

(Reuters) - Sri Lankan stocks fell for a third straight session on Wednesday to a one-week closing low amid foreign outflow as investors worried over volatile global markets and rising returns on risk-free assets. |

Rupee steady amid importer dollar demand, outflows

Reuters - The Sri Lankan rupee closed unchanged on Wednesday amid importer dollar demand and foreign outflows from t-bonds, as banks were reluctant to trade below the 144.00 level desired by the central bank, dealers said. |