Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 30 June 2015 01:22 - - {{hitsCtrl.values.hits}}

Secondary market yields steady despite impressive outcome at bond auctions

By Wealth Trust Securities

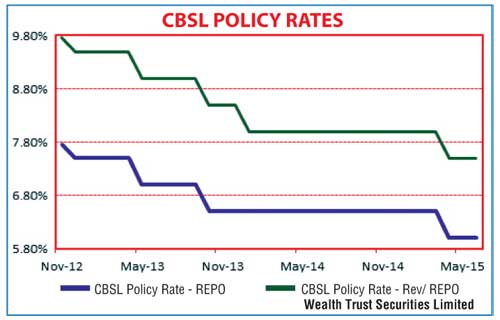

The Central Bank of Sri Lanka was seen holding its policy rates steady at 6.00% and 7.50% for a second consecutive month at its monthly monitory policy announcement yesterday for June.

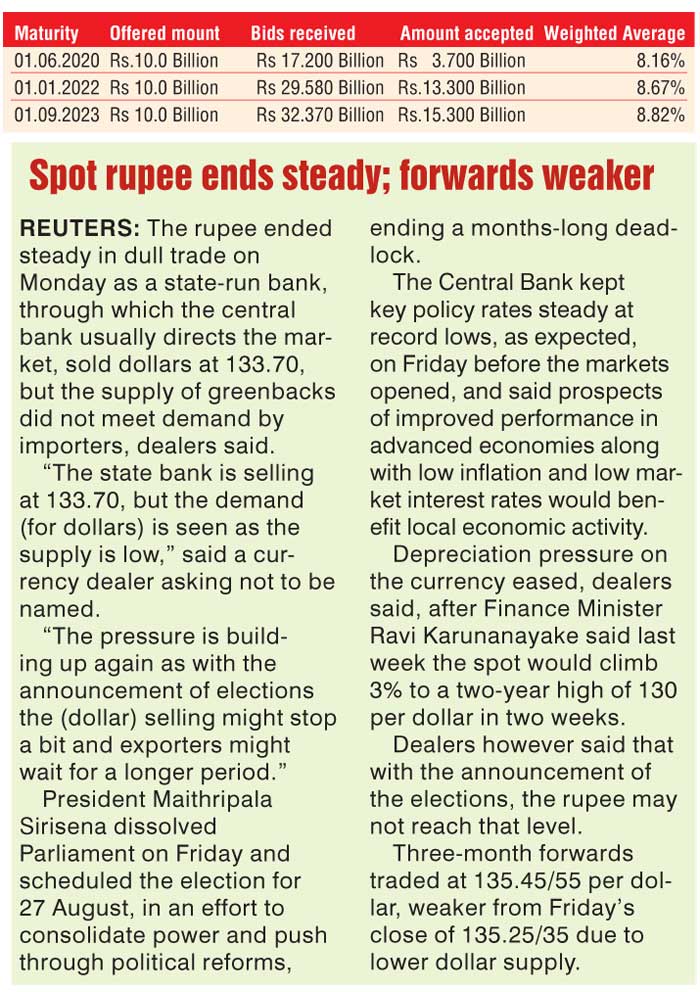

This, coupled with the forthcoming parliamentary elections, saw activity dry up considerably in secondary bond markets, despite the three Treasury bond auctions conducted yesterday recording very impressive weighted averages. The total accepted amount on all three maturities exceeded the total offered amount of Rs. 30 billion by Rs. 2.30 billion.

three Treasury bond auctions conducted yesterday recording very impressive weighted averages. The total accepted amount on all three maturities exceeded the total offered amount of Rs. 30 billion by Rs. 2.30 billion.

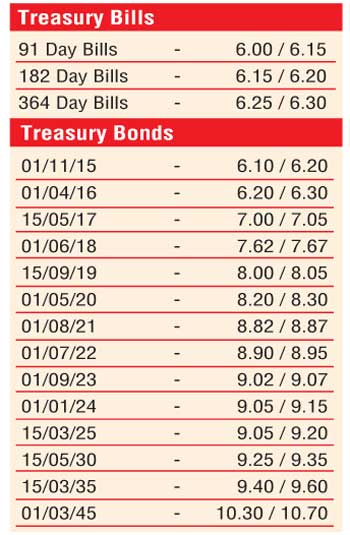

A limited amount of activity was witnessed in secondary bond markets, mainly on the liquid maturities of 01.05.2021, 01.08.2021, 01.07.2022 and 01.09.2023 within a narrow range of 8.88% to 8.90%, 8.84% to 8.86%, 8.90% to 8.95% and 9.04% to 9.06% respectively.

This was ahead of today’s weekly Treasury bill auction, where a total amount of Rs. 20 billion is on offer consisting of Rs. 5 billion, Rs. 6 billion and Rs. 9 billion on the 91-day, 182-day and 364-day maturities respectively. At last week’s auction, the weighted average on all three maturities remained unchanged at 6.08%, 6.18% and 6.28% respectively.

Meanwhile, in money markets, overnight call money and repo rates remained steady to average 6.10% and 5.86% respectively as surplus liquidity increased to Rs. 78.17 billion yesterday.

Rupee remains steady

In Forex markets, the USD/LKR rate on spot contracts remained mostly unchanged to close the day at Rs. 133.70 yesterday. The total USD/LKR traded volume for 26 June was $ 15.15 million. Some of the forward dollar rates that prevailed in the market were three months - 135.30/45 and six months - 136.85/15.