Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 8 June 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Activity in the secondary bond market dipped considerably yesterday ahead of today’s weekly Treasury bill auction.

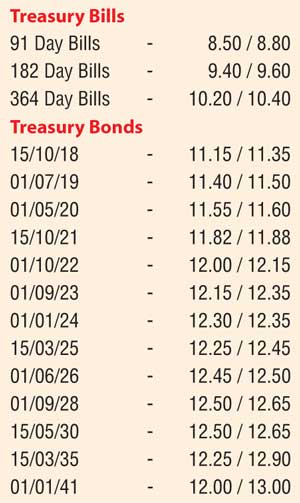

The very limited amount of activity centred on the liquid four maturities of 15.11.18, 15.10.21, 01.01.24 and 06.06.26 within the range of 11.20% to 11.25%, 11.85% to 11.88%, 12.32% to 12.38% and 12.48% to 12.50% respectively.

At today’s Treasury bill auction, a total amount of Rs.30 billion will be on offer consisting of Rs.13 billion on the 91 day, Rs.10 billion on the 182 day and Rs.7 billion on the 364 day maturities. At last week’s auction weighted averages increased across the board to 8.80%, 9.75% and 10.52% respectively.

Meanwhile in money markets, the Open Market Operations (OMO) Department of Central Bank injected an amount for Rs.10 billion for a fourth consecutive day at a weighted average rate of 8.00% as the overnight call money and repo rates averaged 8.17% and 8.02% respectively yesterday.

Rupee continues appreciating trend

The USD/LKR rate on the active spot next contract continued to appreciate yesterday to close the day at Rs.145.85/00. The total USD/LKR traded volume for 6 June was $ 75.80 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 146.70/10; three months – 148.25/75; six months – 150.50/00.