Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 8 March 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

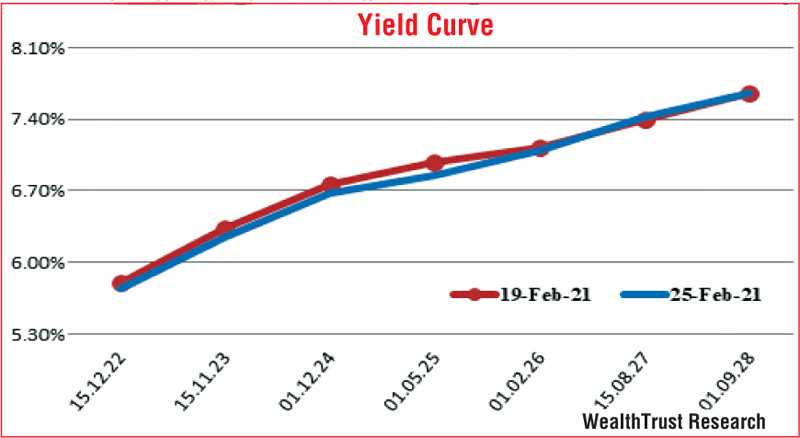

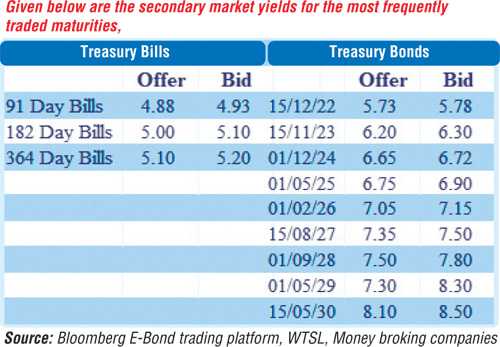

The yields in the secondary bond market fluctuated during the week ending 4 March as it decreased during the early part of the week leading to the weekly Treasury bill auction and monitory policy announcement while increasing towards the latter part of the week following the monetary policy announcement. The liquid maturities of 2022’s (i.e. 01.10.22, 15.12.22), 2023’s (i.e. 15.01.23, 15.11.23, 15.12.23) and 15.09.24 saw their yields decrease to weekly lows of 5.68%, 5.70%, 5.76%, 6.20%, 6.26% and 6.62%, respectively, against its opening highs of 5.76%, 5.86% each, 6.38%, 6.35% and 6.78%. The successful full subscription of the weekly Treasury bill auction along with speculation on the outcome of the monitory policy announcement was seen as the main reasons behind the decrease in yields.

The yields in the secondary bond market fluctuated during the week ending 4 March as it decreased during the early part of the week leading to the weekly Treasury bill auction and monitory policy announcement while increasing towards the latter part of the week following the monetary policy announcement. The liquid maturities of 2022’s (i.e. 01.10.22, 15.12.22), 2023’s (i.e. 15.01.23, 15.11.23, 15.12.23) and 15.09.24 saw their yields decrease to weekly lows of 5.68%, 5.70%, 5.76%, 6.20%, 6.26% and 6.62%, respectively, against its opening highs of 5.76%, 5.86% each, 6.38%, 6.35% and 6.78%. The successful full subscription of the weekly Treasury bill auction along with speculation on the outcome of the monitory policy announcement was seen as the main reasons behind the decrease in yields.

However, renewed selling interest following the monitory policy announcement at where the Central Bank kept its policy rates steady saw yields increase marginally once again toward the latter part of the week mainly on the maturities of 01.10.22, 15.12.22, 15.01.23, 15.11.23 and 15.09.24 to highs of 5.73%, 5.75%, 5.78%, 6.26% and 6.66%, respectively.

Further activity was witnessed on other 2023’s (i.e. 15.03.23, 15.05.23, 15.07.23 & 01.09.23) and 01.12.24 at levels of 6% to 6.25% and 6.70% to 6.79%, respectively, while 2026’s (i.e. 15.01.26 & 01.02.26) and 15.08.27 maturities were seen trading at level of 7.05% and 7.45% to 7.495%, respectively, as well in limited trade. This intern led to the overall yield curve steepening during the week as the short end of the yield curve reflected a marginal downward shift on a week on week basis.

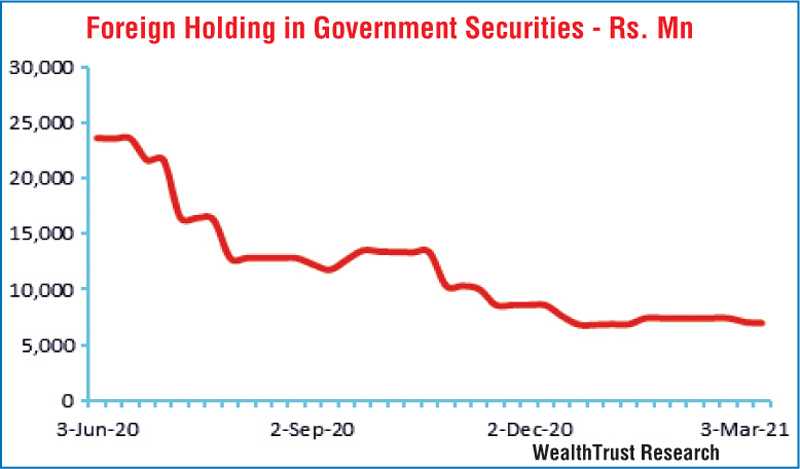

The foreign holding in rupee bonds decreased further with an outflow of Rs. 86.07 million for the week ending 3 March.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 14.55 billion.

In money markets, the total outstanding market liquidity increased marginally to Rs. 172.82 billion in comparison to its previous week of Rs. 171.55 billion while the CBSL’s holding of government securities decreased to Rs. 801.8 billion against its previous week of Rs. 809.96 billion. The weighted average rates on overnight call money and repo remained mostly unchanged to average 4.54% and 4.57%, respectively, for the week.

USD/LKR

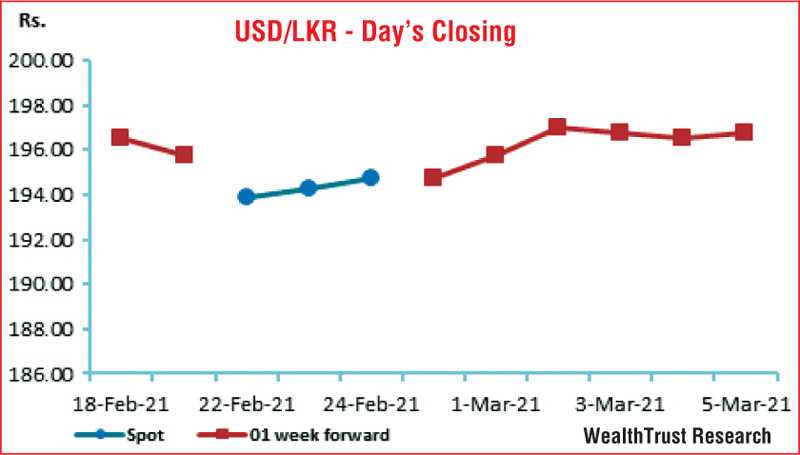

In Forex markets, the USD/LKR rate on the more active one-week forward contracts was seen closing the week at Rs. 196.50/197 in comparison to its previous weeks closing level of Rs. 194.50/195. The spot contracts were traded at the level of Rs. 195 during the week.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 64.94 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)